A newly created cryptocurrency wallet deposited $4 million into Hyperliquid and opened a leveraged short position against Solana (SOL). This move signals strong downside conviction from fresh capital, contrasting with broader market data showing a majority of top traders remain heavily long on the asset as its price trades within a defined downward channel.

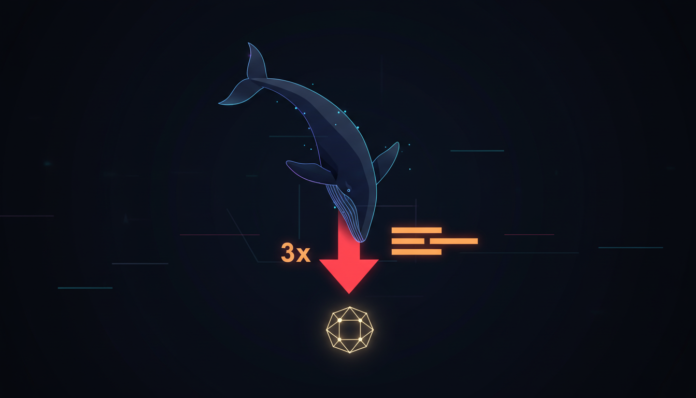

A newly created wallet deposited $4 million into the Hyperliquid perpetual futures exchange and initiated a 3x leveraged short position on SOL. This action shows clear downside intent rather than hedging behavior.

Solana’s price remained locked inside a descending channel on the daily chart, recently rejecting near the $120 level. The asset was trading near the lower channel boundary around $90 with its daily RSI indicating sustained selling pressure.

Data from CoinGlass shows Binance top traders are skewed heavily long, with long accounts near 82% and short accounts close to 18%. This crowded positioning creates vulnerability if the price fails to recover.

Across the broader derivatives market, Open Interest declined by roughly 4.37% to about $6.19 billion. This contraction signals traders are reducing leverage and closing positions.

Recent liquidation data showed long positions absorbing most of the pressure, with roughly $3.59 million in long liquidations compared to about $733,000 in shorts. Major exchanges including Binance, Bybit, and OKX all recorded heavier long liquidations.

The market sits at a junction where a well-capitalized directional short clashes with crowded long exposure. Weak momentum and declining Open Interest suggest cleanup is occurring rather than a relief rally forming.