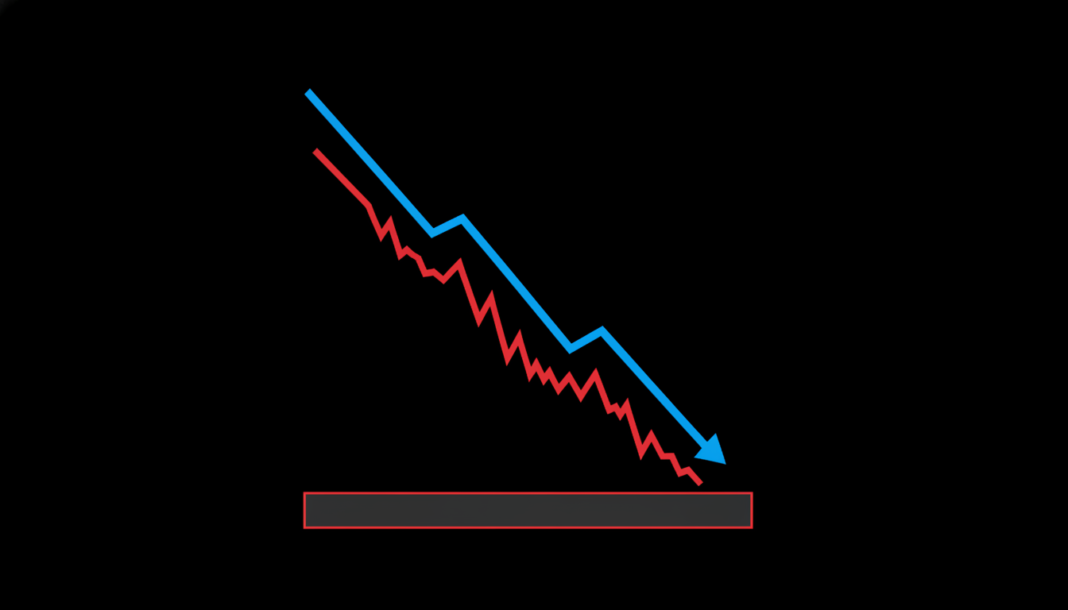

Monero (XMR) has declined 43.8% after hitting a new all-time high near $800 in mid-January. The privacy token is now testing crucial support levels, with technical indicators suggesting potential for further losses. Analysis indicates traders may look to sell any price bounce toward key liquidity zones, pending confirmation of a longer-term bearish trend.

The cryptocurrency Monero reached a new all-time high of $799.89 in mid-January alongside a heavy increase in trading volume. It has since retraced 43.8% from that peak.

A recent analysis highlighted that XMR was likely to pull back toward the $520 and $400-$440 regions. The token has now retraced a significant portion of its rally from August and is resting atop a key support level.

On the daily timeframe, the swing structure remained unbroken despite a bearish internal shift during the retracement. The Chaikin Money Flow was below -0.05, and the Relative Strength Index fell below the neutral 50.

Monero was also trading below its 20 and 50-day moving averages. These signs collectively showed that further losses were possible for the asset.

With Bitcoin facing selling pressure, the situation appeared difficult for XMR bulls. The rally to all-time highs exhibited a classic, high-volume blow-off top pattern.

A drop below the $411.5 level would confirm an indication trend on the 1-day chart. The bullish argument for new all-time highs does not seem to hold water based on current conditions.

After collecting liquidity around $450-$480, XMR bounced higher on January 26th. This bounce has the potential to target northern liquidity pools at $500-$510 and $560-$580.

Traders are advised to watch for a drop below $411.5 to confirm longer-term bearishness. Alternatively, a bounce toward these magnetic zones could present a selling opportunity for a reversal.

The speed of the XMR rally and its cool-off suggested the run might be over, especially given pressure on Bitcoin. A price bounce toward $560 would be for selling, unless Bitcoin reclaims the $94,500 resistance.