Solana (SOL) is testing a historically significant support level that could signal a price reversal, according to technical analysis. The asset traded at $124.50 amid a 40% drop in daily trading volume, suggesting market caution. Meanwhile, institutional interest persists as data shows continued capital inflows into U.S. spot Solana ETFs.

Solana appeared to be entering a potential price reversal as it traded near a historically significant level. SOL was changing hands at $124.50, though trading volume had declined by 40% to $3.67 billion.

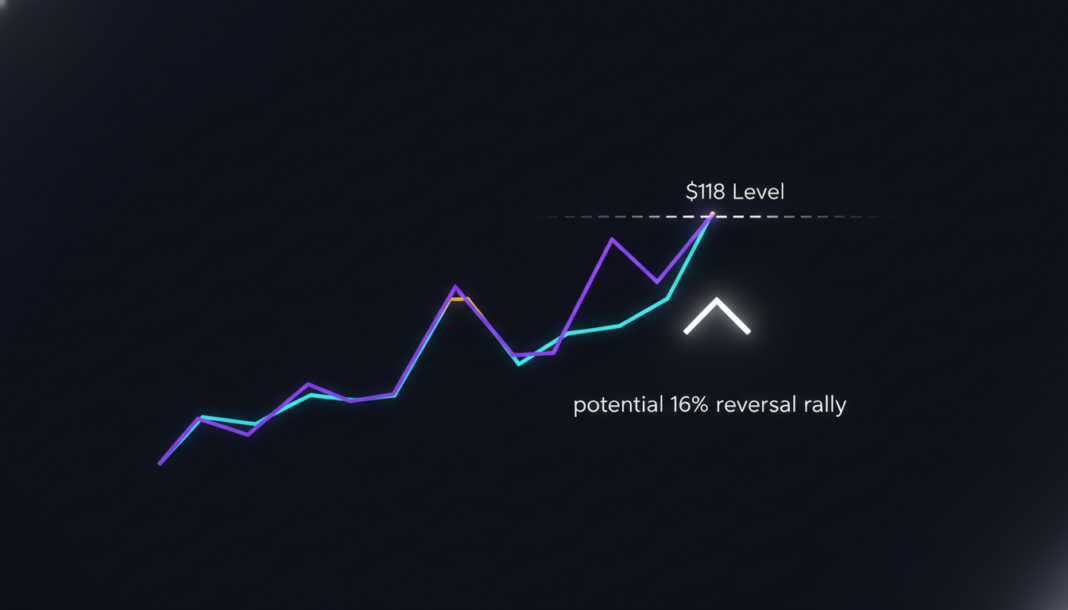

This drop in activity suggested growing caution among traders. The price was hovering near a key support level of $118.

On the daily chart, SOL has tested the $118 level more than ten times since April 2024. A similar reversal could lead to a price increase of around 16%, potentially reaching $146.

This bullish thesis would only be validated if SOL remains above $118. The asset’s price remained below the 50-day Exponential Moving Average, indicating an overall downtrend.

Despite market uncertainty, Wall Street investors showed strong interest in Spot Solana ETFs. Data from SoSoValue reveals capital has consistently flowed into these funds since January 16th.

Inflows suggest fresh capital is entering the underlying asset. Solana’s Total Value Locked also increased by 4.66% to $36.66 billion, according to DeFiLlama.

Intraday traders appear to be aligning with the bullish price action. Data from CoinGlass shows traders are overleveraged at $121.3 on the downside and $125.7 on the upside.

Traders have built approximately $157.18 million in long-leveraged positions versus $66.71 million in short positions. This indicates short-term market sentiment for SOL remains bullish.