Pendle (PENDLE) extended its bearish trend, dropping over 6% to trade near $1.88. The token remains confined to a descending channel on its daily chart, with declining trading volume indicating reduced short-term interest. Momentum indicators like the RSI and MACD suggest the downside pressure may be slowing as the price consolidates near a key channel support zone between $1.90 and $2.00.

The cryptocurrency Pendle continued its downward trajectory, sliding more than 6% in 24 hours as selling pressure persisted. At the time of writing, PENDLE was trading at $1.88, according to CoinMarketCap data, with its daily volume falling 12% to $49.8 million.

Market capitalization declined nearly 5% to $312.3 million, reinforcing a short-term bearish outlook. Analyst Globe of Crypto noted PENDLE is trading inside a well-defined descending channel on the daily chart.

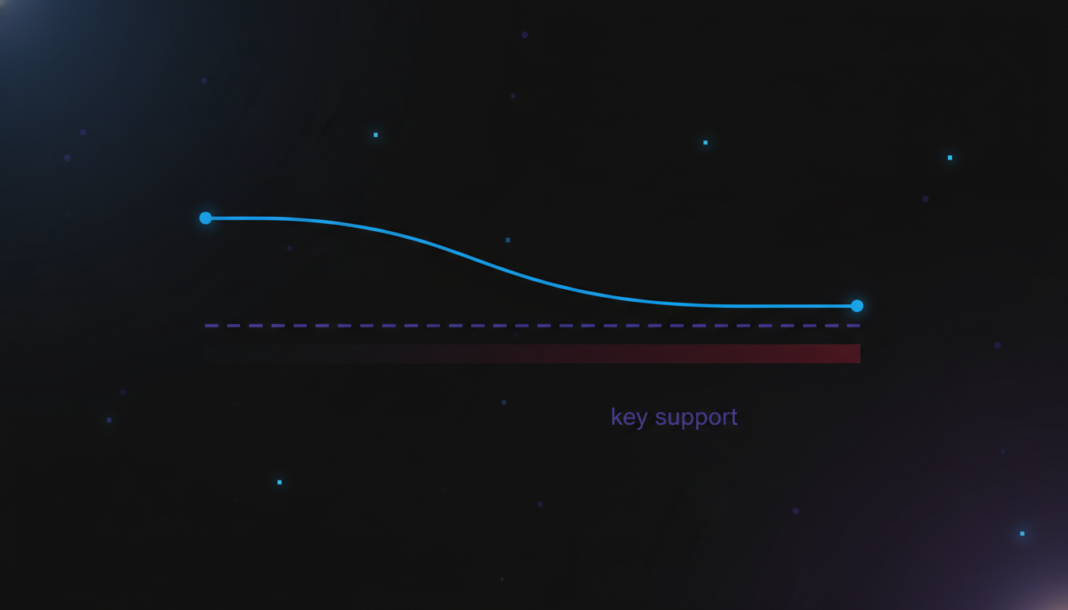

Price action shows lower highs and lower lows since a September peak near $6.50. The current price sits close to the channel’s lower boundary, which has historically acted as a reactive support area.

The latest candles show reduced bearish pressure and consolidation around the $1.90-$2.00 level. The selling pressure momentum from the sale has eased somewhat as the prices continue to consolidate and tighten around the support level of the channel.

Analysts suggest a confirmed breakout through the descending resistance line could signal a reversal. The measured move for such a breakout targets an area between $4.20 and $4.30.

Near-term resistance levels are identified at $2.50 and $3.00. The bullish scenario would be invalidated if the price fails to hold the channel’s support.

Momentum indicators suggest the bears may be running out of steam. The weekly RSI is hovering around the 36 level, while the MACD histogram shows shrinking bars.

The MACD is in negative territory, and the signal line is trading above the MACD line. This reduction in bearish momentum could indicate a period of consolidation pending increased buying interest.

Pendle is approaching a vital support zone between $1.90 and $2.00. With selling pressure easing and momentum indicators losing downward strength, the stage may be set for a consolidation period.