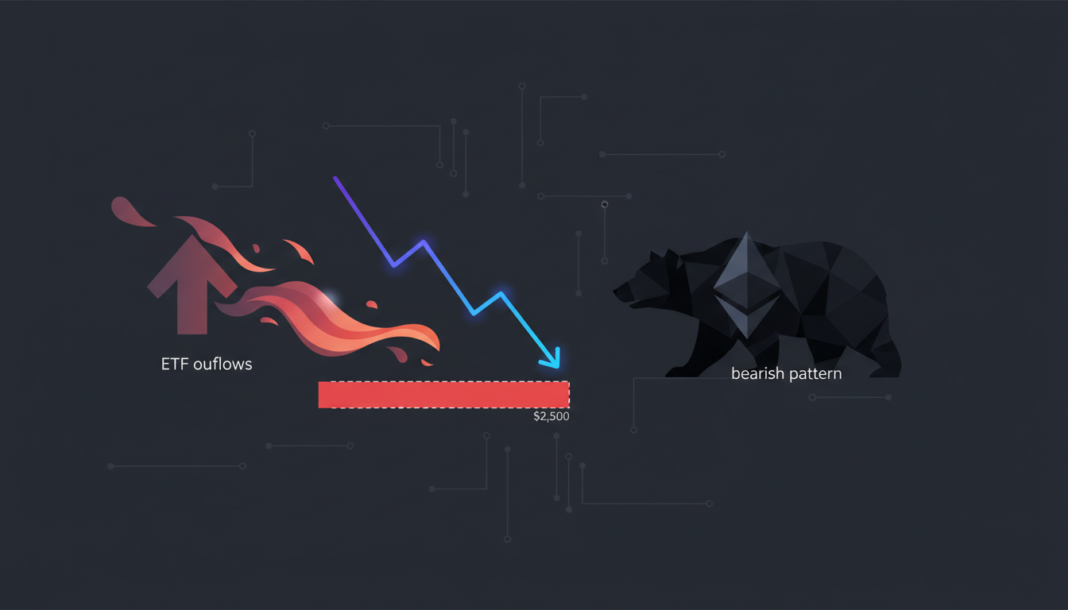

Ethereum’s price nears the critical $2,500-$2,600 support level amid significant institutional outflows. A bearish ‘head and shoulders’ pattern has formed on its weekly chart, while data shows a surge in spot market buying volume. The asset’s next move from this key zone is seen as crucial for its near-term direction.

Ethereum is approaching a vital support zone between $2,500 and $2,600, previously strengthened by ETF and accumulation activity. After falling below $2,800, the asset has shown signs of weakness as institutional outflows increase.

At press time, Ethereum was trading at $2,692 and forming a classic ‘head and shoulders’ pattern on the weekly timeframe. The pattern’s completion could signal a bearish trend, though longer-term charts continue to show bullish signals.

On January 30, Ethereum ETFs saw a staggering $113 million in outflows, adding pressure to the asset. This brought the week’s total outflows to $58.4 million, according to on-chain data from Lookonchain.

However, data from CryptoQuant shows Ethereum’s Spot Taker Buy Dominant volume surged as buyers stepped in aggressively once ETH dropped below $3,000. This buying pressure surpassed levels last seen in June 2025, suggesting underlying resilience.

The market now faces a critical inflection point influenced by these conflicting signals. A potential U.S. government shutdown and ongoing institutional outflows challenge Ethereum’s ability to hold its ground.

Still, the noted Taker Buy Dominance indicates some buyer strength remains present. The asset’s future in the short term hinges on whether this key support level holds or fails.