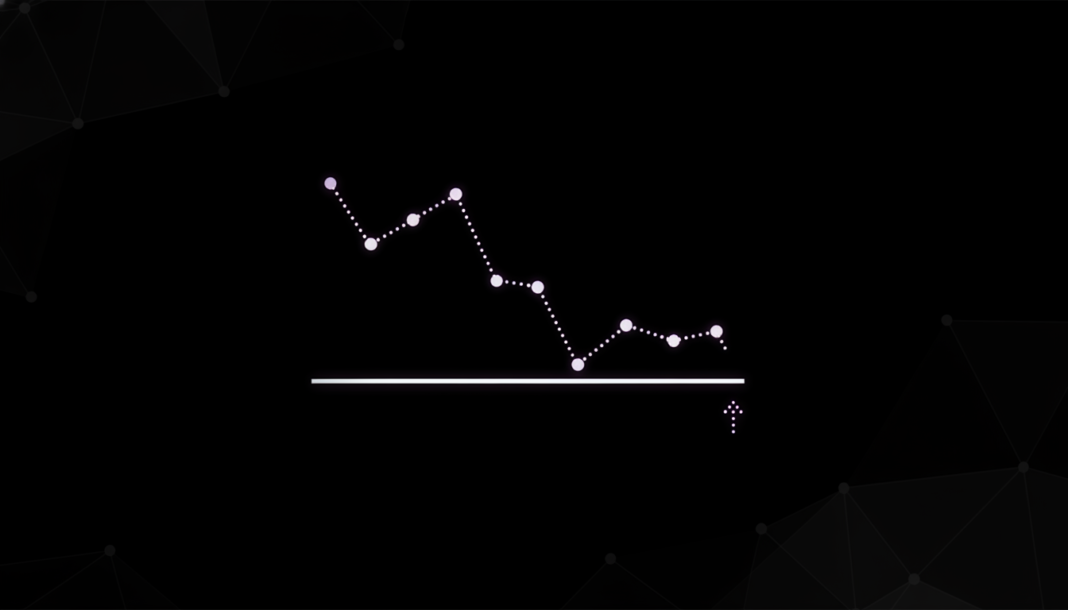

Polkadot’s DOT token is testing a critical long-term support level at the lower boundary of a falling wedge pattern observed on its 2-week chart. Technical indicators show the market is oversold, which could signal a potential short-term bounce. However, the broader trend remains bearish, with the cryptocurrency trading below all major moving averages and key resistance levels capping any recovery path.

The Polkadot (DOT) token is testing a crucial support level while confined within a long-term falling wedge structure. This pattern has been forming since the 2021 peak, with volume declining alongside the wedge’s progression.

Analyst Jonathan Carter stated, if DOT holds at the support area, the price may move in steps from $3.00 to $24.00 if the bulls make their presence felt. The recent price action shows signs of accumulation, forming a small base after a significant decline.

On shorter timeframes, DOT’s technical outlook remains negative. The cryptocurrency trades below all major exponential moving averages, including the 20, 50, 100, and 200-day EMAs.

The Relative Strength Index reads 26.33, indicating oversold conditions that could precede a relief rally. The MACD indicator also confirms a strong downtrend, with its line below the signal line.

Key resistance for a potential recovery begins near $1.88 at the 20-day EMA. Stronger resistance levels are positioned at $2.02 and $2.32, corresponding to the 50 and 100-day EMAs.

The 200-day EMA at $2.88 represents a significant barrier to any sustained bullish reversal. On the downside, critical support is found at $1.40, with a break potentially leading to a test of the $1.20 level.