The SUI token is holding a critical demand zone between $1.12 and $1.14, following a sharp weekly decline of over 21%. Analysts warn that a breakdown could see prices fall toward $1.05 or $1.00, while technical indicators show sustained bearish pressure as trading volume and open interest drop significantly.

The SUI token is trading at $1.13, marking a slight daily gain amid a steep weekly loss of 21.15%. Trading volume has fallen sharply to $636 million, according to data from CoinMarketCap.

Analyst Jonathan Carter highlighted that SUI remains above structural support on its two-day chart. “A confirmed rebound could lead to the opening of upside targets at $1.35, $2.00, $2.70, $3.70, and $5.00,” he stated, identifying $0.80 as a key stop-loss level.

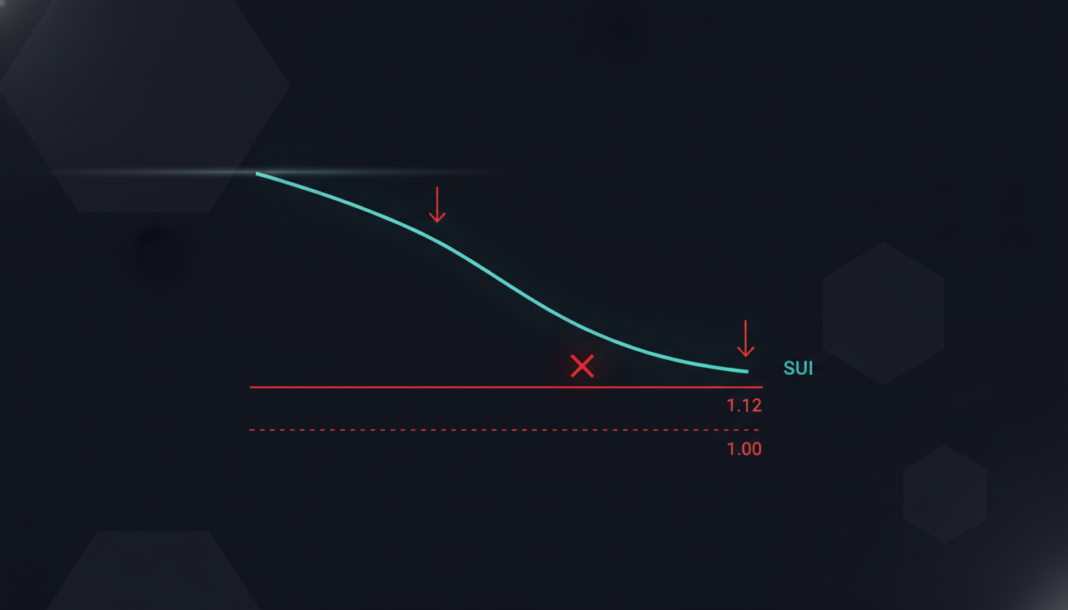

Analyst BitGuru noted the token continues to hold the $1.12-$1.14 demand zone. He added that breakdown risks could push SUI toward $1.05 or $1.00, while reclaiming $1.25-$1.30 or $1.36-$1.40 resistance is needed to shift the trend.

Market data shows a 40% drop in futures volume to $845 million, as reported by CoinGlass. Open interest saw a marginal decline, with a slightly negative funding rate.

Technical analysis reveals the price is trading below all major Exponential Moving Averages, signaling strong bearish pressure. The tightening Bollinger Bands also indicate compressed volatility, with SUI hovering near the lower band.