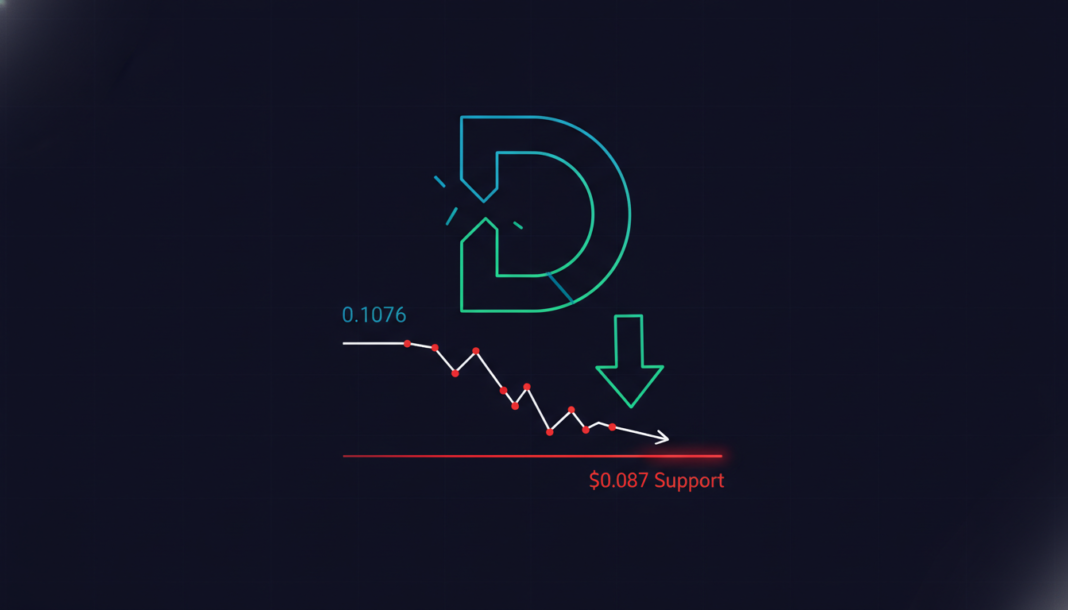

Dogecoin is trading at $0.1076 after a minor 1.33% gain, with its price entering a sharp downtrend. Analysts report it has fallen below the $0.1174 support level and is now targeting $0.087. The long-term 1-week 350-day moving average is a critical support; a decisive break below could see DOGE fall toward $0.060 or even historical lows near $0.035, according to technical analysis.

The price of Dogecoin (DOGE) is attempting a minor recovery amid a broader bear market. On February 4, 2026, DOGE trades at $0.1076 with a 24-hour volume of $3.45 billion.

According to a recent post by Crypto TXG, DOGE saw a brief rally from the $0.1174 support before momentum failed. The price has since fallen decisively below that level, entering a strong downtrend. Analysts expect the decline to continue toward the next significant structural support at $0.087, where a potential bounce could occur. The asset is ranging between major long-term support and resistance levels following a flash crash in October 2025. The 1-week 50-day moving average continues to act as a cap on price movements.

The 1-week 350-day moving average is now a critical support level for the meme coin. A sustained fall below this level could see Dogecoin target the 0.786 Fibonacci level at $0.060. In worst-case scenarios, historical precedent points to a potential correction toward the $0.035 level, noted in previous market cycles. Sinewave cycle analysis suggests the timing of the cycle may be more accurate than predicting a price bottom. This analysis indicates the next major low for DOGE could materialize around October 2026.

The current 1.33% appreciation offers a modest degree of short-term stability. Market participants are closely watching to see if the key moving average support will hold.