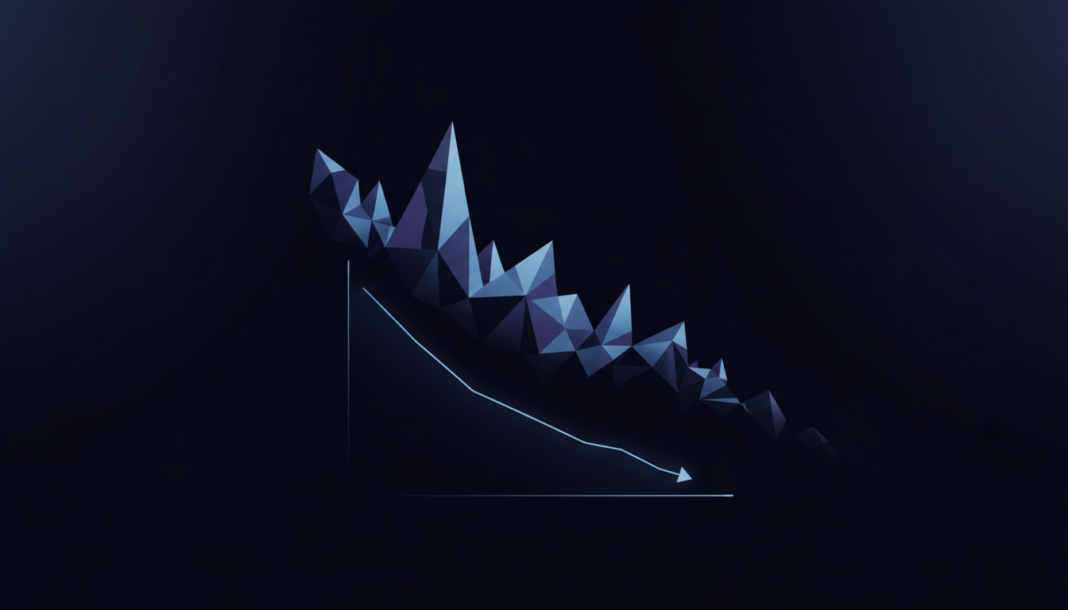

Bitcoin’s price briefly dipped to $72,000 on February 3rd, leading multiple analysts to declare an ongoing “crypto winter.” Bitwise CIO Matt Hougan stated the bear market began in January 2025, while CryptoQuant’s Julio Moreno pinpointed November 2025 as the start, projecting a potential end by Q3 2026. Analysts are assessing support levels, with Nansen’s Aurelie Barthere eyeing a test of the $70,000 level.

Bitcoin’s brief dip to $72,000 has reinforced analyst views that a bear market is underway. Matt Hougan, CIO of digital asset manager Bitwise, stated the “crypto winter” began in January 2025 and that substantial ETF demand was the main market support.

Hougan noted bear markets typically last 13 months but doubted the current phase would extend to November 2026. Julio Moreno, Head of Research at CryptoQuant, agreed with the analysis but differed on timing, suggesting the bear market started in November 2025.

Moreno’s current expectation is for the phase to end in the third quarter of 2026. This aligns with Bitcoin’s drop below the critical 50-week Exponential Moving Average and the $100,000 level that same month. Analysts are now assessing where a market bottom might form.

Aurelie Barthere, Principal Research Analyst at Nansen, expects the bearish move to lead Bitcoin to test $70,000 support. She mentioned that a potential adoption of the CLARITY Act by Congress could help stabilize prices. On-chain data, however, suggests the market may still be far from a true bottom.

The MVRV Z-Score metric is sloping downwards toward the fair-value zone that marked past cycle lows. Meanwhile, Fundstrat’s Tom Lee said that ‘all pieces’ were in place for the market to rebound, offering a contrasting viewpoint.