Bitcoin faced increased selling pressure as major traders pulled back from bullish positions. Whales reduced long exposure and opened short positions, while retail traders maintained optimism. Market data showed declining U.S. demand and a contraction in trading volume, suggesting near-term headwinds for BTC’s price.

Bitcoin’s price fell to a session low of $72,945 as selling pressure intensified across the market. The move followed a clear shift where whales scaled back bullish bets, but retail traders largely held their ground.

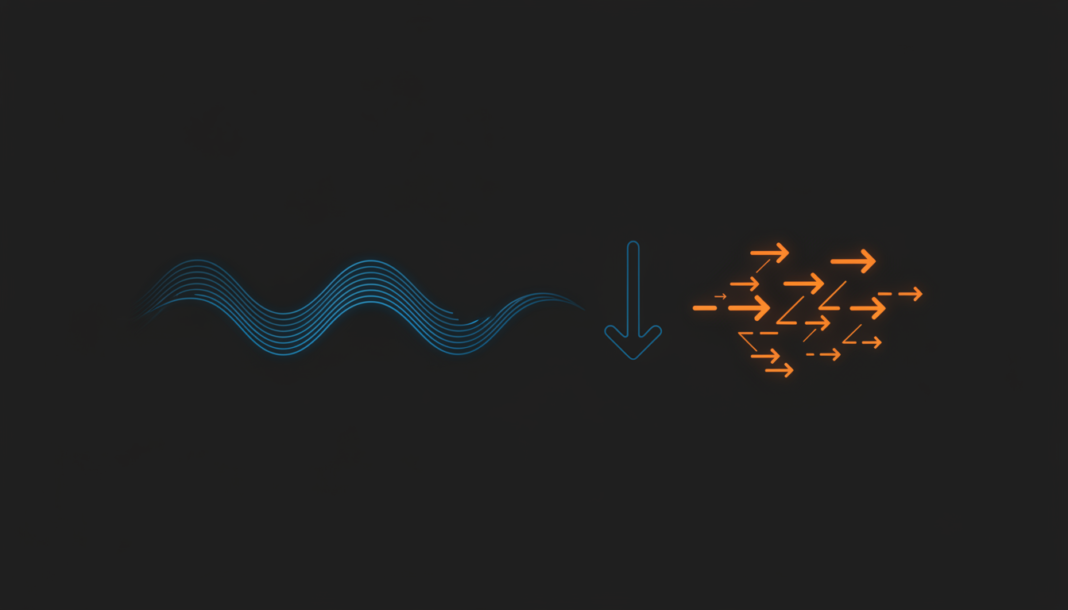

Recent data from the perpetual futures market highlights a widening gap between whale and retail trader behavior. According to Whales vs. Retail data, whales reduced their long exposure over the past day, closing existing positions while opening new shorts.

João Wedson, founder of Alphractal, described the shift as part of whales’ opportunistic trading approach. “They hunt volatility, open longs and shorts aggressively, and later reduce exposure,” Wedson said.

Such repositioning often precedes a consolidation phase or accelerated selling pressure. Historically, comparable whale-driven unwinds have preceded sharp declines in Bitcoin’s price.

Bitcoin’s Funding Rate remains slightly positive at roughly 0.0040%, according to CoinGlass. Despite this, trading volume trends show a growing dominance of short volume over longs in the perpetual market.

Spot market indicators paint a less supportive picture. The Coinbase Premium Index has trended lower, pointing to weakening demand from U.S. investors.

The Fund Market Premium has also slipped into negative territory, suggesting subdued institutional demand. Across the wider market, spot trading activity has declined sharply since October 2025.

A recent $10 billion contraction in stablecoin market capitalization has further deepened this demand shortfall. Reduced stablecoin liquidity signals investor reluctance to deploy capital into digital assets.