Dogecoin is trading near a crucial $0.10 support level amidst ongoing market volatility, according to data. Analysts are re-examining the meme coin’s potential, citing its historical bull-cycle gains of 95x and 310x. Speculative price targets reaching as high as $5 are being discussed, but experts note these depend heavily on future market conditions.

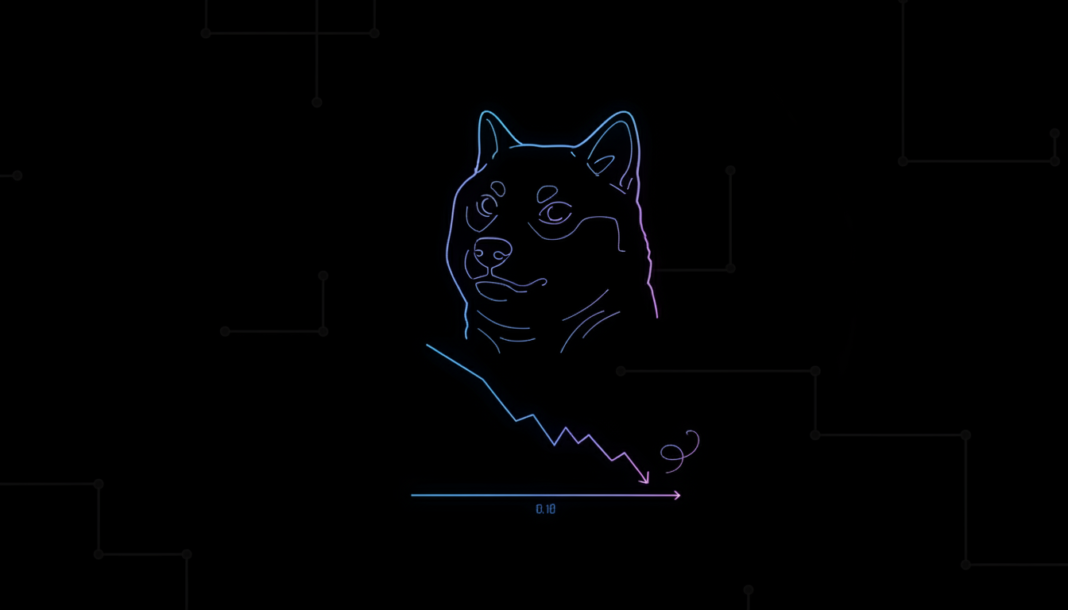

Dogecoin (DOGE) is trading near the key $0.10 support level as broader crypto markets consolidate. This keeps speculative assets like DOGE under close watch from traders and short-term investors.

A crypto analyst named Hailey LUNC highlighted the token’s past performance in market growth phases. The DOGE token has seen an estimated 95x growth during the first bull cycle, followed by an even higher growth of approximately 310x during the second bull cycle.

This historical cycle structure fuels speculation about the price potentially reaching levels as high as $5. Analysts note such projections remain speculative and depend on various factors including general market inflows, Bitcoin dominance, and retail participation.

Technical analysis shows DOGE’s weekly chart continues to display a bearish structure. The price is trading below key moving averages, which have now turned into resistance levels, and has been making lower highs since late 2024.

According to TradingView data, the 200-week moving average near the mid-$0.15 mark remains a significant technical hurdle. Traders warn that a close below the $0.10 support could lead to a test of lower historical demand zones. Conversely, holding this support may put DOGE back on traders’ watchlists.