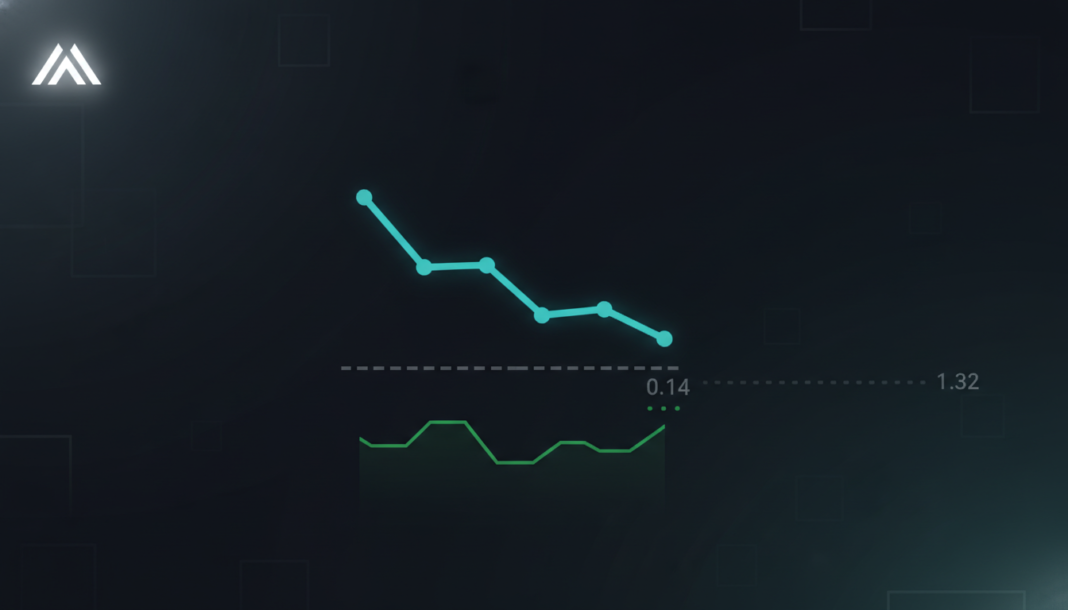

Cardano (ADA) is testing a historically significant support zone between $0.14 and $0.18 as its price declines. Trading at $0.2499, ADA’s technical indicators show oversold conditions, with analysts noting this zone preceded major rallies in past cycles. The potential for a future rally is contrasted by current bearish momentum and persistent selling pressure.

The cryptocurrency Cardano (ADA) is currently testing a major historical support zone between $0.14 and $0.18. At press time on February 6, ADA was trading at $0.2499 with a 24-hour trading volume of $2.93 billion and a market capitalization of $9.09 billion.

Analyst Crypto Patel noted that this zone previously triggered a 2100% price rise during the 2021 bull run. “Every time this zone has been touched, we have seen huge rallies, including a 600% rally in 2024,” Patel stated.

Technical indicators reveal strong bearish pressure for ADA. The Relative Strength Index is deeply oversold at 27.63, and the price trades significantly below all major weekly moving averages.

Further bearish signs are indicated by the Moving Average Convergence Divergence (MACD). The MACD line is at -0.0170, which is below the signal line, with a negative histogram at -0.0957.

Despite the downturn, analysis points to a potential accumulation phase ahead of a future rally. Patel’s historical pattern analysis suggests price targets between $0.40 to $1.32, with an extended target of $3.10 possible.

The analysis sets a weekly price close below $0.10 as an invalidation point for this scenario. Investors are advised to monitor these key price levels closely as Cardano approaches a historically critical juncture.