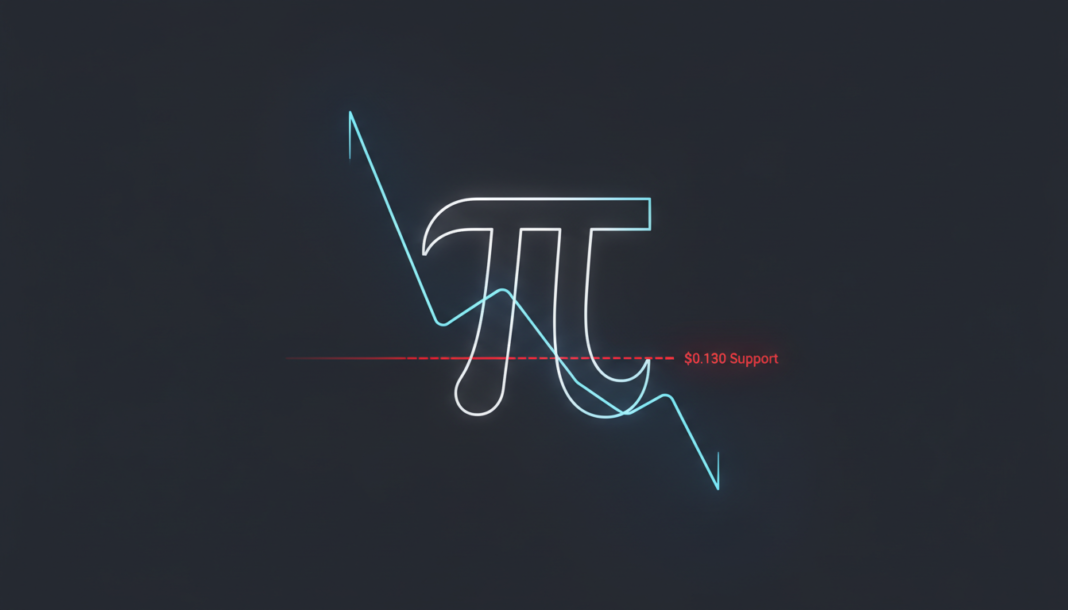

Pi cryptocurrency’s price declined sharply, breaking below the key $0.190 support level. Sellers drove a decisive breakdown, accelerating a bearish trend. The price is now compressing towards the $0.130 liquidity floor, which represents a critical test for demand. This move occurred amid broader market weakness, with the total crypto market cap falling over 5%. Trading volume for Pi surged over 126%, validating aggressive distribution.

Pi’s price action has maintained a clearly defined bearish structure with downside momentum accelerating. Following a consolidation above $0.190, sellers forced a decisive breakdown that quickly shifted market positioning. That decline showed intent, with candle bodies expanding on the lower trend and repeated closes printing near the lower session.

Structurally, the $0.190-level turned into resistance following the breakdown. Ongoing selling pressure and lack of buyers now increase the risk of prices moving down to the $0.1302 support level. If the next sessions continue to follow the same pattern of selling, this level will serve as a test for demand.

At the time of writing, Pi’s price seemed to be compressing towards the $0.130 liquidity floor. As the price approaches this range, liquidity concentration increases, which can slow accelerated declines while testing sellers’ commitment. Consequently, absorption probability rises if resting bids convert into aggressive market buys.

This is often reflected through long lower wicks and firmer closes above $0.130. In turn, tighter candle bodies may develop too, signaling an early demand response. However, sweep risk remains elevated if expanding sell volume overrides the bid wall.

Moreover, broader market weakness or liquidity rotation could hasten that breach. Should the price close below $0.130, it may quickly enter a low-liquidity pocket near $0.115, exposing further downside towards the $0.100 historical demand zone. Here, it’s worth pointing out that the broader market weakness set the tone first.

The total crypto market cap declined by 5.04%, while Pi fell alongside the broader market. This is a sign of widespread risk-off positioning. Selling pressure then intensified across altcoins. However, Bitcoin’s dominance expanded, diverting liquidity away from secondary assets.

At press time, Pi was trading at $0.1444. Its trading volume surged by 126.75% to $35.3 million, validating aggressive distribution rather than passive drift. The altcoin’s near-term momentum will remain fragile as long as bearish pressure persists.

This is particularly true as Bitcoin searches for its own structural support on the charts. If macro conditions stabilize, Pi could transition into a consolidation phase above recent lows. However, failure to maintain the prevailing structure would expose further downside risk.