Solana’s SOL token entered a consolidation phase after a recent downturn, with technical analysis pointing to a potential short-term retracement toward the $104-$110 zone. Blockchain activity surged, however, as the network achieved a record high of 1,852 transactions per second on February 7 while maintaining low median fees.

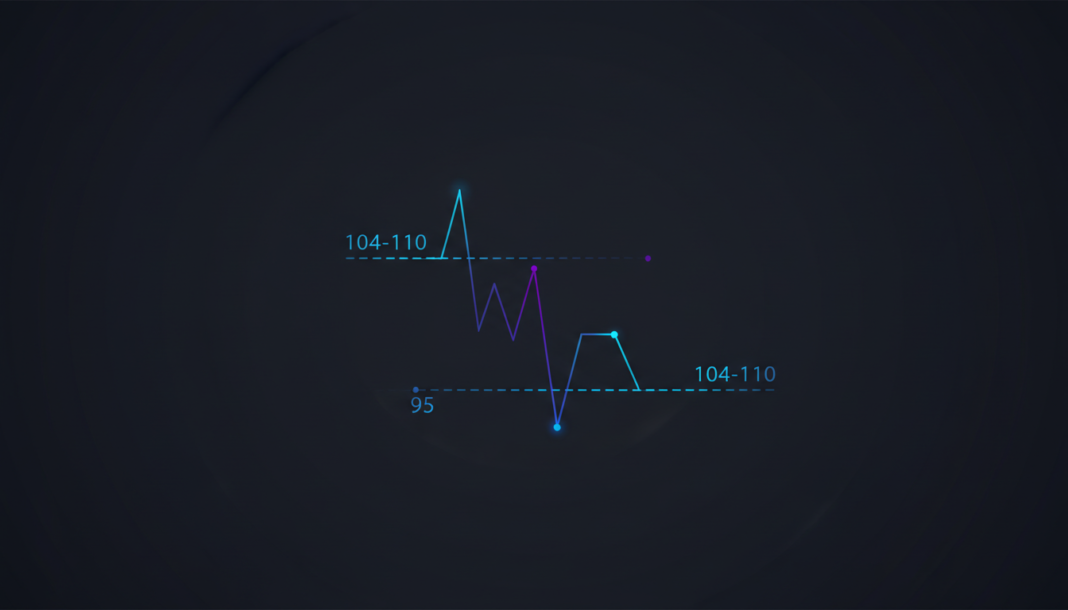

The Solana blockchain’s native asset, SOL, is in a consolidation phase with technical indicators suggesting a potential short-term retracement. According to crypto analyst Crypto Pulse, Fibonacci retracement levels have converged between $104 and $110, a zone which often acts as a reset area for price after strong momentum moves.

Deeper technical outlooks suggest SOL remains in a short-term downtrend. Momentum indicators are showing signs of stabilization but have not yet signaled a trend reversal.

Despite the price action, the Solana network itself recorded a historic on-chain high on February 6. According to crypto analyst Vibhu, the network averaged 1,852 transactions per second while median fees remained extremely low at about $0.0005. This occurred while other major networks reportedly faced delays and much higher fees.

The milestone day also saw the supply of USDT on Solana cross $3 billion. Record tokenized equities volume and peak wrapped asset transactions were also noted.