Hedera’s HBAR token shows signs of a potential technical recovery after a prolonged downtrend. The price stabilized following a capitulation event near $0.077, with momentum indicators improving. This recovery aligns with news of Hedera joining a key digital currency policy forum alongside other major blockchain networks.

Persistent selling pressure defined Hedera‘s structure, keeping HBAR’s price locked within a descending channel that saw it slide from $0.134 toward $0.087. Each upward move weakened near the upper trendline, reflecting firm overhead supply before support at $0.097 eventually failed. The sell-off extended momentum toward a $0.073 liquidity floor with volume expanding during declines, confirming active distribution.

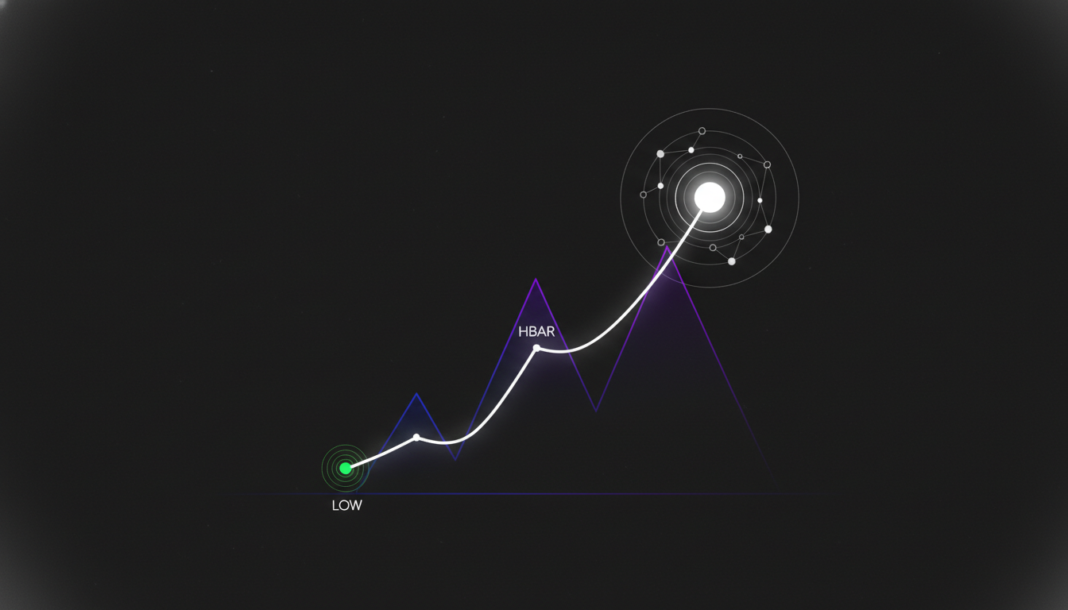

The recovery process began after selling pressure peaked near the $0.07766 demand zone, where a long capitulation wick formed. As liquidations cleared, volume spiked sharply, signaling panic exhaustion rather than fresh distribution before price stabilized above $0.080. The rebound extended toward $0.090, where price now consolidates beneath former support-turned-resistance as the RSI recovered toward 53, reflecting strengthening momentum.

This technical recovery aligns with a key structural narrative, as Hedera joined the Digital Monetary Institute in early February 2026. The partnership, which was mentioned online, places the network within a policy-shaping forum led by OMFIF alongside central banks, payment firms, and select blockchain networks like Ripple and ConsenSys. This institutional validation appears strategically timed with the market’s improving sentiment.