Litecoin (LTC) is stabilizing above a key $45–$47 support zone following a market-wide downturn, with analysts identifying the area as a potential accumulation point. Technical indicators show improving momentum, with resistance anticipated near $55–$57. Sustained buying pressure could theoretically push the cryptocurrency toward much higher targets, according to expert analysis.

Litecoin is holding above the $45–$47 demand zone as Bitcoin rebounds from $60,000. This stabilization signals potential short-term upward momentum after LTC declined over 10% in the past week.

Crypto analyst Surf highlighted this support range as aligning with the 0.786 Fibonacci retracement. Surf highlights this area as a strong demand zone where long-term investors may begin accumulating.

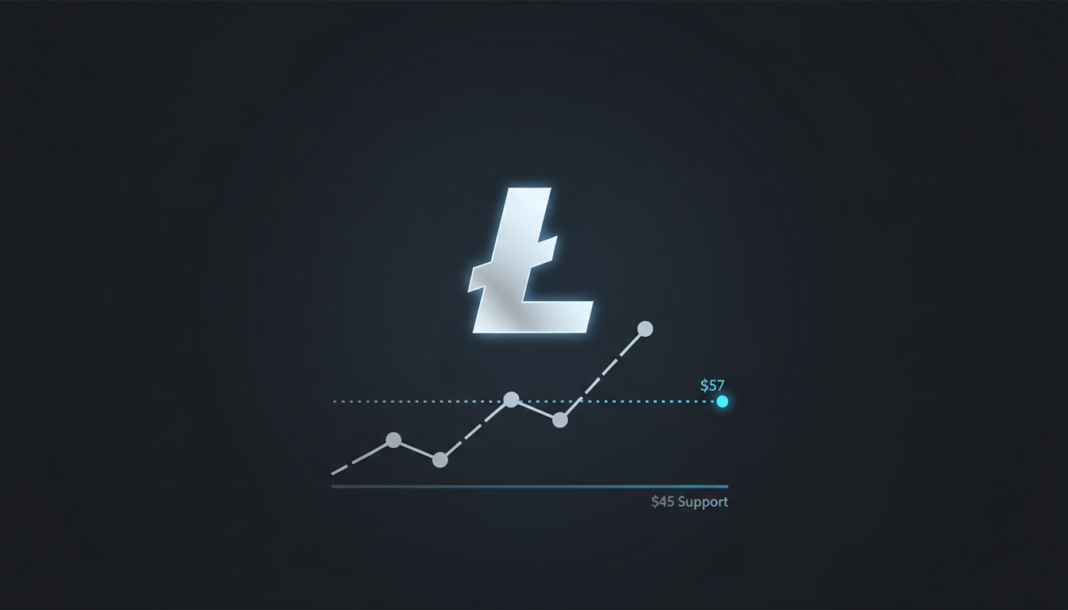

If buying interest increases, LTC could test resistance between $55 and $57. Further sustained momentum might eventually push the price toward a $102 target, based on prevailing market conditions.

Technical analysis shows LTC resting on the 20-period simple moving average within the Bollinger Bands. The upper Bollinger Band currently sits near $60.7, while dynamic support is noted at $49.1.

The MACD indicator shows the MACD line has crossed above its signal line, moving from negative to neutral territory. The histogram size remains relatively low, suggesting traders are watching for stronger buying force to challenge the overall downtrend.

As of Saturday, LTC traded at $54.42 with a 24-hour volume of $514 million according to CoinMarketCap. Its market capitalization was reported at $4.15 billion.