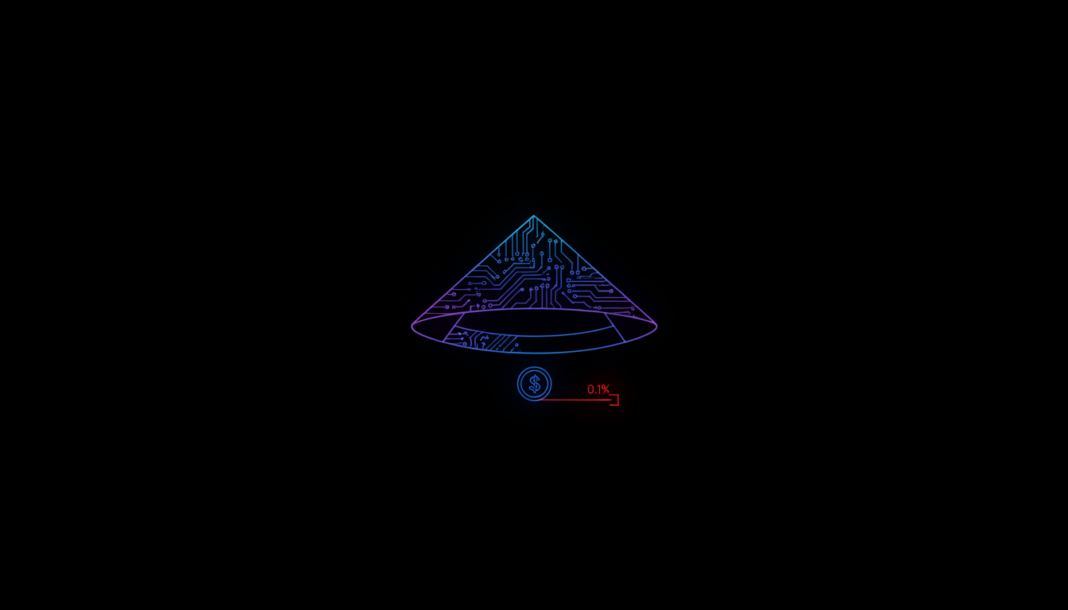

Vietnam’s Ministry of Finance has proposed a new tax framework for cryptocurrency transactions, treating them similarly to securities. Under the draft, individuals trading on licensed platforms would pay a 0.1% personal income tax on total transaction value, while companies face a 20% corporate income tax. The rules are part of a five-year pilot program designed to bring controlled oversight to the crypto market, requiring all activities to be conducted in Vietnamese Dong.

Vietnam’s finance ministry has released a draft outlining how crypto asset transfers and trading will be taxed. The proposal seeks to bring clarity and structure to a market previously operating under interim rules.

Individuals transferring or trading crypto through licensed exchange platforms would pay a 0.1% personal income tax on the total transaction value. This tax applies to turnover, regardless of whether the trader makes a profit or a loss.

The ministry noted this approach is similar to how other securities are taxed in Vietnam. Traders would not be charged value-added tax on their transactions under the new law.

For Vietnamese companies earning income from digital asset transfers, a corporate income tax rate of 20% is proposed. Taxable income would be calculated as the selling price minus the purchase price and related expenses.

The proposed tax rules are linked to Vietnam’s official five-year pilot program for managing the crypto market. The pilot began in September 2025 and requires all crypto activities to be conducted exclusively in Vietnamese Dong.

Authorities state the goal is to ensure market safety, transparency, and protect participants’ rights. The pilot is designed to be implemented in a cautious and tightly controlled manner.