The memecoin SIREN surged to a fresh all-time high of $0.36 before a significant pullback, with its price at $0.26 at press time. The rally was fueled by aggressive accumulation by large holders and a surge in trading activity across both spot and derivatives markets, indicating strong buyer conviction.

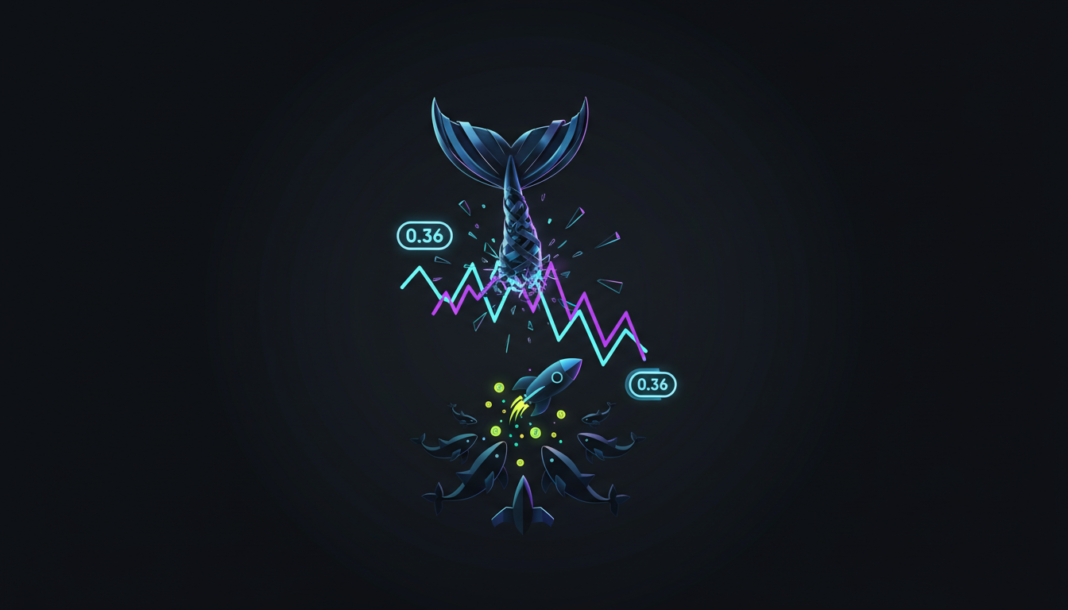

The cryptocurrency SIREN broke out from a period of sideways trading, rallying to a new all-time high of $0.36. Following this peak, the asset experienced a sharp correction, trading at $0.26 at press time, reflecting a 174.2% daily increase.

Market data reveals a substantial rise in network activity and capital flows for the memecoin. Its trading volume surged by 3,294% to $42 million, while its market capitalization exceeded $200 million.

Aggressive accumulation by whales has been a key driver of the price action. According to Nansen, top holders added 700 million SIREN tokens over three days while selling only 65 million, resulting in a net positive balance change above 600 million. This activity signaled a clear shift toward buyer dominance in the market.

The trend extended into the derivatives sector, where participation increased markedly. Data from Coinglass shows the Open Interest rose 402% to $51 million, and derivatives volume skyrocketed 12,418% to $1.62 billion. The Long/Short Ratio climbed to 1.05, indicating that a majority of traders, particularly Binance Top Traders, were positioned for further gains.

Technical indicators reflected the strong bullish momentum, with the price crossing above key moving averages. However, the Relative Strength Index (RSI) reached an overbought level of 88, hinting at potential selling pressure. OnchainSchool observed at least one holder offloading $2.6 million in tokens, which posed a risk to the uptrend.

The sustainability of the rally now hinges on whether buyer demand can withstand profit-taking pressure. If demand persists, the asset could reclaim the $0.30 level, while panic in the futures market might drive a retracement to $0.11.