The integration of Maple Finance‘s SyrupUSDC into Aave‘s lending markets has rapidly channeled institutional credit yields into DeFi. Since its launch on Base in January 2026, a $50 million deposit cap was quickly filled, driving cumulative inflows above $750 million across chains. This movement highlights a growing convergence where structured credit products are gaining composability within on-chain lending.

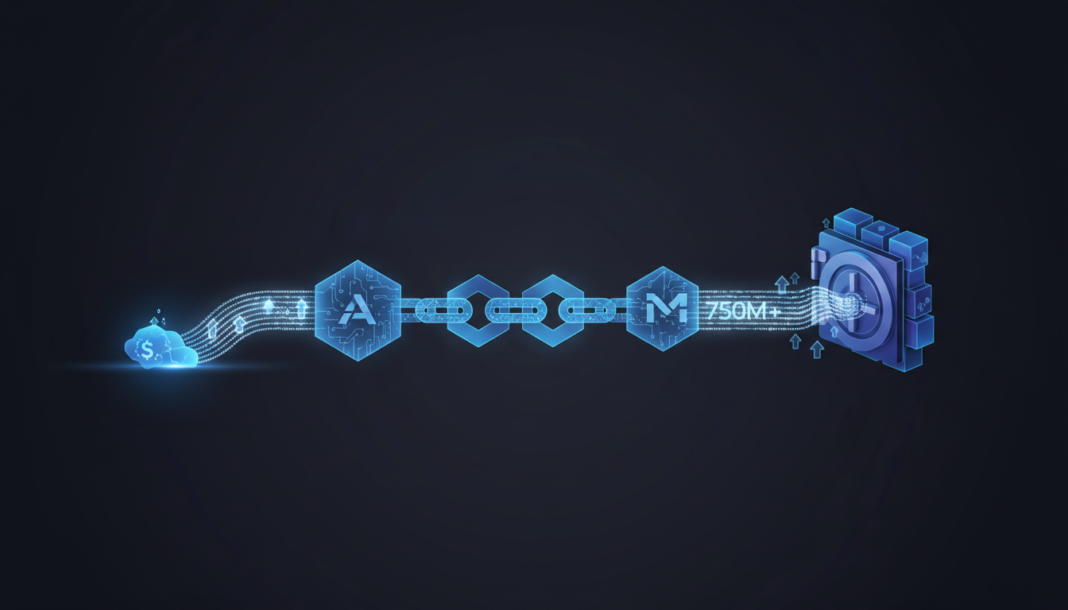

A strategic partnership between Aave and Maple Finance is actively bridging institutional credit with decentralized finance liquidity. The collaboration began taking shape in late 2025, with initial launches on Ethereum Core and Plasma to test credit demand and establish liquidity rails.

Expansion moved to Base in early 2026, with SyrupUSDC deployed around January 22. Following governance approval, it was onboarded into Aave V3 on that network. Market response was immediate, as a $50 million deposit cap filled rapidly, signaling strong user demand.

This progression highlighted how structured credit products are gaining composability within lending markets. The model funnels yields from Maple’s institutional loans directly into DeFi through the SyrupUSDC token.

Maple Finance issues short-duration, overcollateralized loans to trading firms and fintech borrowers, generating yields between 5–9%. The protocol has originated over $17 billion in loans historically, with more than $11.27 billion issued in 2025 alone, as data shows. Outstanding credit supports SyrupUSDC minting, strengthening DeFi’s income layer.

On Base, weekly transfer volume climbed toward $2.3 billion, reflecting heightened capital movement. However, flow composition revealed a layered structure, with a significant share originating from liquidity recycling. As noted, yield looping drove transfer spikes more than real payments, even as Base strengthened its role as a Layer-2 credit hub.

The integration has accelerated both capital formation and protocol-level liquidity depth. Cross-chain integrations increased the flow of structured credit, boosting SyrupUSDC liquidity and attracting institutional yield into DeFi lending markets.