The decentralized lending protocol Aave reported significant growth in January 2026, with its total value locked increasing to $57.33 billion. Active loans climbed to $23.25 billion while protocol fees reached $75.13 million, according to a recent data report.

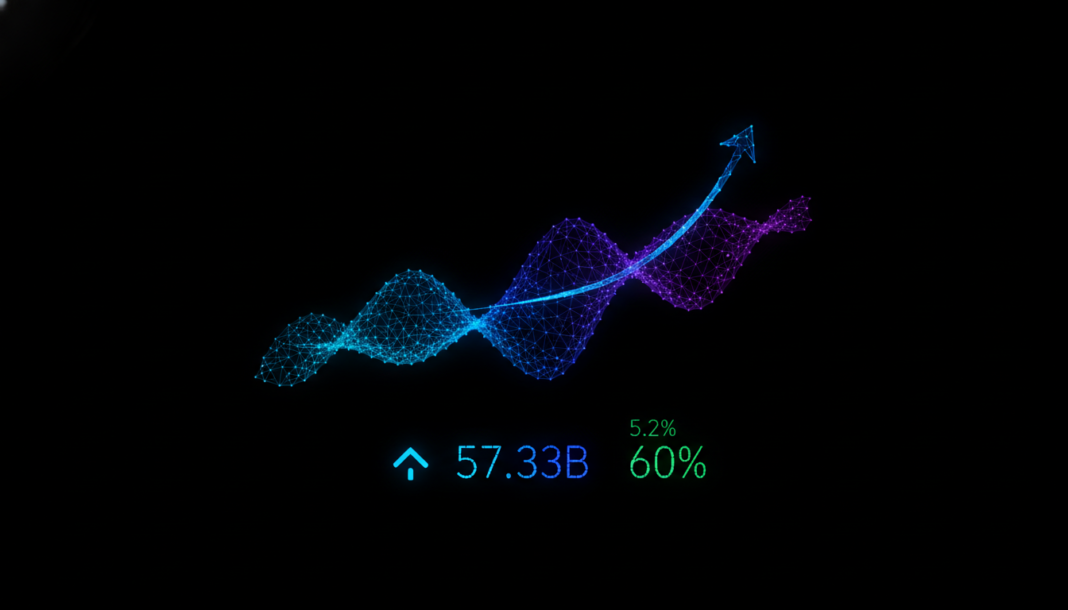

The decentralized lending protocol Aave saw its total value locked rise to $57.33 billion in January, a 5.2% monthly increase and a nearly 60% annual gain according to Token Terminal’s latest report. Active loans on the platform also grew to $23.25 billion during the period.

Cumulative loans originated on the protocol are approaching $1 trillion since its launch. The protocol’s share of the total DeFi lending market has grown substantially over the past two years.

Ethereum remains the dominant network, accounting for over 80% of deposits, loans, fees, and revenue. Activity is expanding on other chains including Plasma, Arbitrum One, and Base.

Stablecoins played a significant role, with PYUSD deposits exceeding $400 million. Over $15 billion in stablecoin supply has passed through the Aave ecosystem.

Protocol fees for January totaled $75.13 million, marking a nearly 15% increase from December. DAO revenue followed a similar trend, rising to $9.96 million.

Monthly active users declined to approximately 114,600, down from both the previous month and year. Despite this, Aave maintains a commanding lead in the DeFi lending sector.