Bitcoin sits at a critical juncture as analysts present conflicting near-term outlooks, with some predicting a violent short squeeze rally while others foresee months of consolidation between $45,000 and $55,000. Prediction market users on Myriad now see a 44% chance of a surge to $84,000, nearly doubling from last week, indicating a shift toward bullish sentiment. Long-term, experts agree Bitcoin is evolving into a non-sovereign store of value amid macroeconomic shifts.

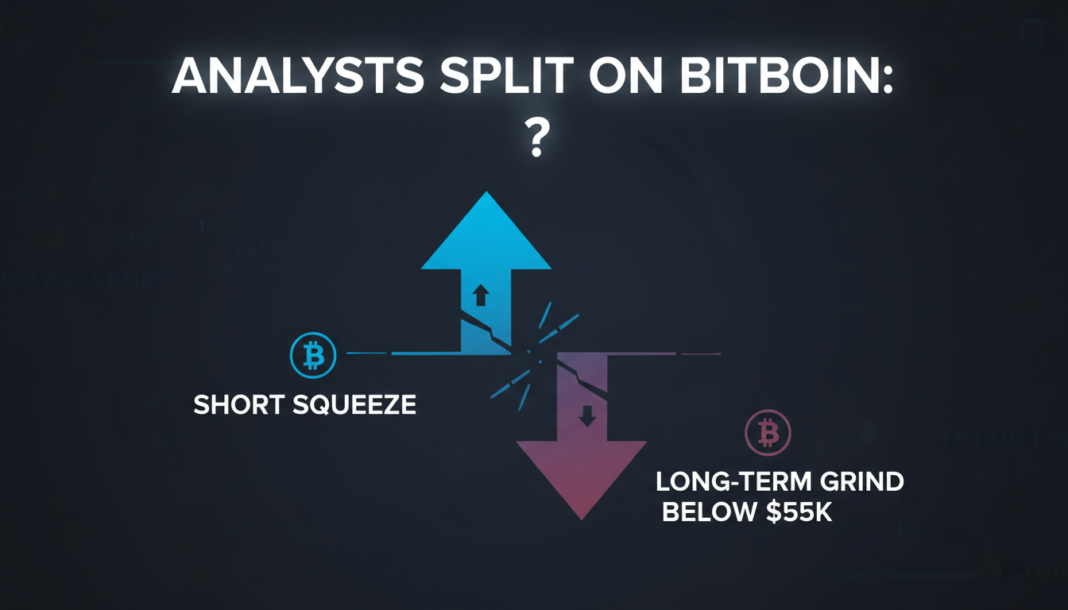

Analysts are deeply divided on Bitcoin’s immediate price trajectory following its nearly 45% decline from its October 2025 peak. While Nicholas Motz, CEO of ORQO Group, forecasts a “violent, upside expansion driven by a mechanical short squeeze,” others like Connor Howe, CEO of Enso, anticipate a prolonged “gravity phase” with prices grinding between $45,000 and $55,000 for the next 6-12 months.

Market sentiment shows a tilt toward optimism in the short term. Users on the prediction market Myriad now assign a 44% probability to Bitcoin rallying to $84,000, a significant increase from 24.8% last Friday. This contrasts with sentiment for other assets, where the chance of Ethereum reaching $3,000 is placed at only 30%.

The case for a rebound hinges on market structure and trapped bearish bets. Motz argues that as price resists breaking down, a ‘pain trade’ could force trapped shorts to cover, sending the market vertical. SynFutures CEO Rachel Lin noted that deeper institutional participation and more liquid derivatives markets now help dampen extreme price moves.

Conversely, the bear case emphasizes the macroeconomic backdrop and the digestion of last year’s excess. Howe points to “ETF-driven excess… and trapped supply from the highs” as reasons for an extended consolidation period. Despite the near-term disagreement, a long-term consensus is forming around Bitcoin’s evolving role.

Experts agree Bitcoin is fundamentally shifting from a speculative asset to a macro hedge. Motz framed this as an inevitable transition as the world enters an era of “Fiscal Dominance,” where sovereign debt concerns override central bank policy. This positions Bitcoin as a sought-after non-sovereign store of value in the long term.