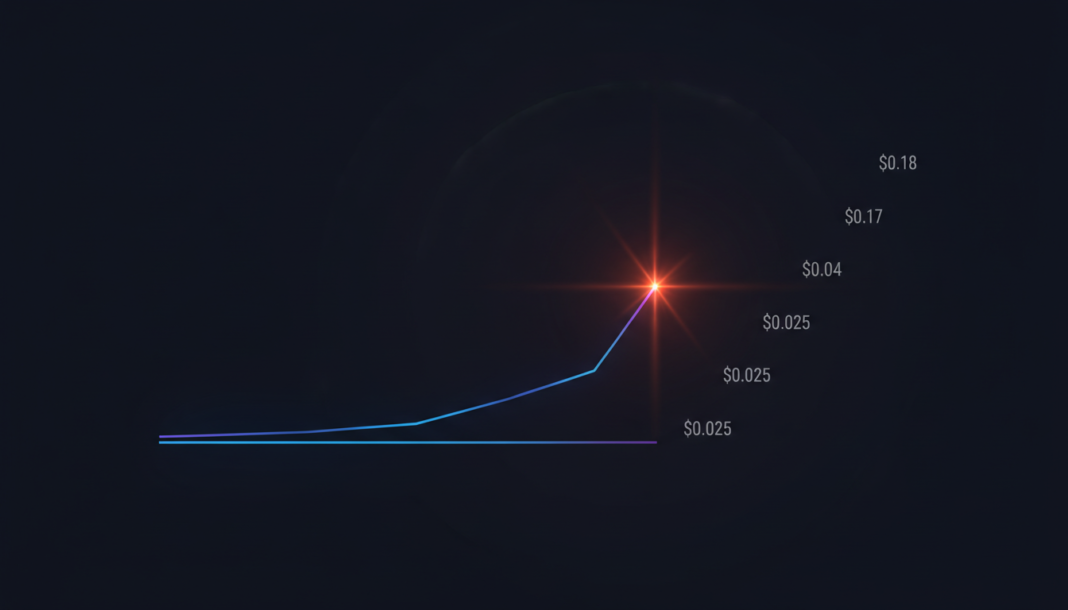

Market observers highlight Flare Network’s potential role in tokenized finance as its FLR token trades near long-term support. The asset has consolidated for approximately 2.5 years, with technical analysis pointing to a potential bullish reversal pattern. Market commentator CasiTrades described Flare as one of crypto’s most underrated projects, with upside breakout targets ranging up to $0.18 if momentum shifts.

Flare Network is drawing attention for its focus on enhancing the utility of tokenized assets through smart contracts and interoperability. Market commentator CasiTrades described Flare as “one of the most underrated projects in crypto.” The network seeks to act as an execution layer where tokenized assets can generate activity across different ecosystems.

Technically, the FLR/USD pair has been compressed in a consolidation phase around all-time lows between $0.009 and $0.010. The daily chart shows a falling wedge pattern, which is typically considered a bullish reversal signal.

Fibonacci retracement analysis points to an initial strong resistance zone between $0.025 and $0.026. Further resistance levels are identified at $0.032 and $0.037, with wider areas around $0.044 and $0.050.

CasiTrades also provided extension targets near $0.135 and $0.18 should a sustained upward breakout occur. TradingView data shows FLR trading at approximately $0.0095 on the weekly chart, indicating continued weakness. The price has retraced nearly 85% from its peak in mid-2024.

Key support is seen between $0.0080 and $0.0090, with a weekly close below potentially leading to further declines toward $0.006 to $0.007. For a confirmed trend change, FLR must close above the $0.012 to $0.014 zone and subsequently overcome $0.018.