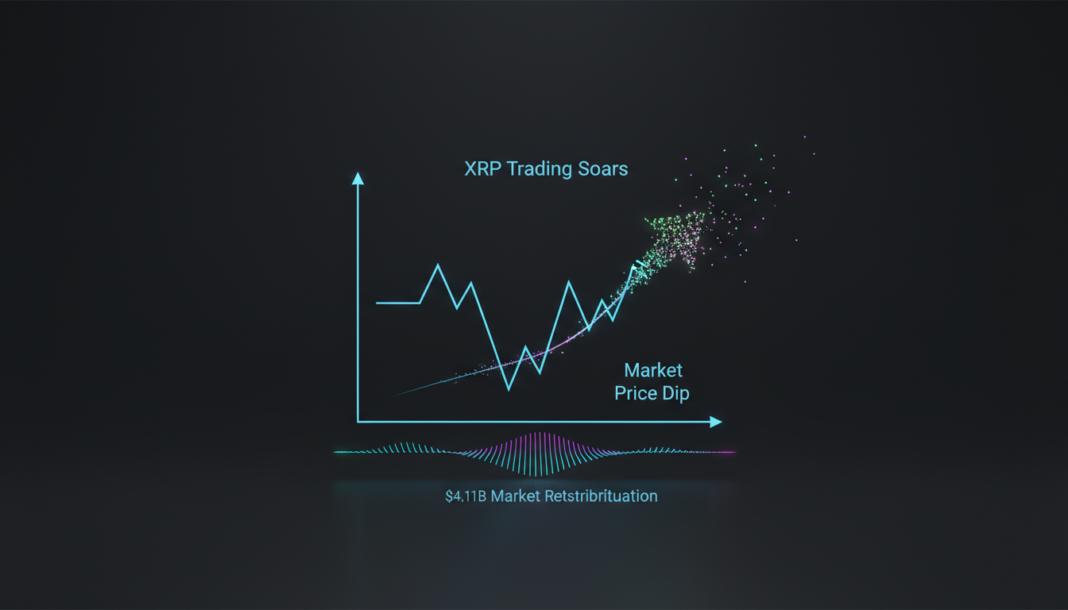

XRP is experiencing significant market activity despite a recent price dip, with on-chain data pointing to a redistribution phase. The token recorded over $4 billion in weekly trading volume, predominantly on South Korea’s Upbit. Analysts note the combination of high volume and a modest price decline suggests accumulation by stronger holders.

XRP trading activity surged with a weekly volume of $4.11 billion, primarily driven by South Korea’s leading exchange, Upbit. Despite this high volume, the asset’s price declined by 5.06% to $1.38 based on data from CoinCodex.

Crypto analyst X Finance Bull highlighted the figures, stating “The 7-day trading volume for the XRP is $4.11 billion, with the largest volume occurring on South Korea’s top exchange, Upbit.” The high volume paired with a minor price drop indicates active market redistribution rather than panic selling.

On-chain metrics show the Spent Output Profit Ratio (SOPR) hovering around 1.0, signaling trades are occurring at break-even levels. This is typical in phases where weaker holders sell and stronger investors accumulate, which can precede a price trend change.

XRP dominated trading volumes in Korea throughout 2025, outperforming both Bitcoin and Ethereum on Upbit. A separate transaction demonstrated the efficiency of the XRP Ledger, where transferring 4.8 million XRP cost only $0.02.

Analysts view this activity as a reshaping of the market structure. Observing volume trends and support levels will be key to determining the token’s next significant move.