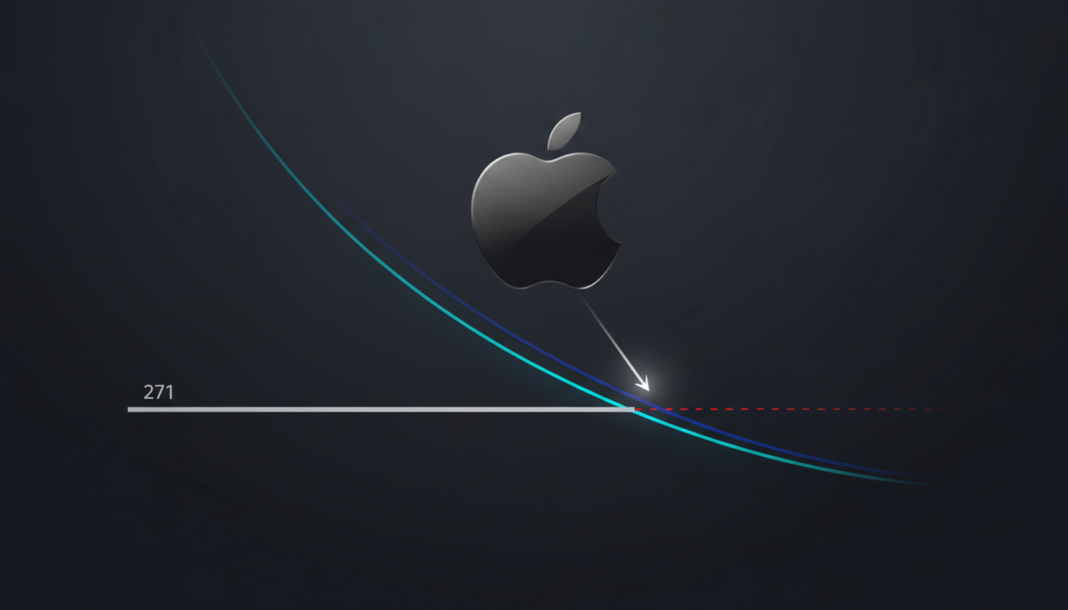

Apple Inc. stock is approaching a key technical support level near $271, drawing attention to potential short-term downside risks. Recent chart data identifies immediate support at $271.84, with further levels at $267.75 and $263.74. A break below the $271 zone could increase selling pressure for the heavily traded equity.

Apple Inc. (NASDAQ: AAPL) is nearing a key technical support zone near $271. Short-term price movement is gaining attention from investors observing downside risk levels.

Recent chart data underlines three significant support levels at $271.84, $267.75, and $263.74. The $271 area surfaces as the immediate focus on the 15-minute chart.

The asset recently traded near $275.49 after pulling back from a local high near $280.18. This decrease has brought price action near the first identified support at $271.84.

According to CoinMarketCap, at the time of writing, the asset is trading at $261.73 with a 4.99% decrease in rate. The asset’s market cap has exceeded $3.84 trillion, and the daily volume is around $10.48 billion.

Apple shares have fluctuated within a defined intraday range, with resistance appearing near $280. A failure to reclaim that level preceded the current pullback.

If the price stabilizes near $271.84, it would confirm the level as near-term support. A breakdown below that threshold would shift focus to $267.75.

Further downside could bring $263.74 into play, which marks the third identified support level. These levels are derived from recent price consolidation zones and prior reaction lows.

As trading continues, the $271 level stands as the immediate technical area of interest. Short-term market participants are closely watching this key zone.