Solana (SOL) is trading at $83.94, holding above a key support level of $76. Despite ongoing bearish pressure indicated by its MACD, analyst Ali Martinez projects potential upside to the $82-$88 range if current buying momentum holds. The asset remains below its major moving averages, signaling the broader downtrend is still intact.

Solana is trading at $83.94, holding above the critical $76 support zone. The asset saw a 3.36% increase over the past 24 hours.

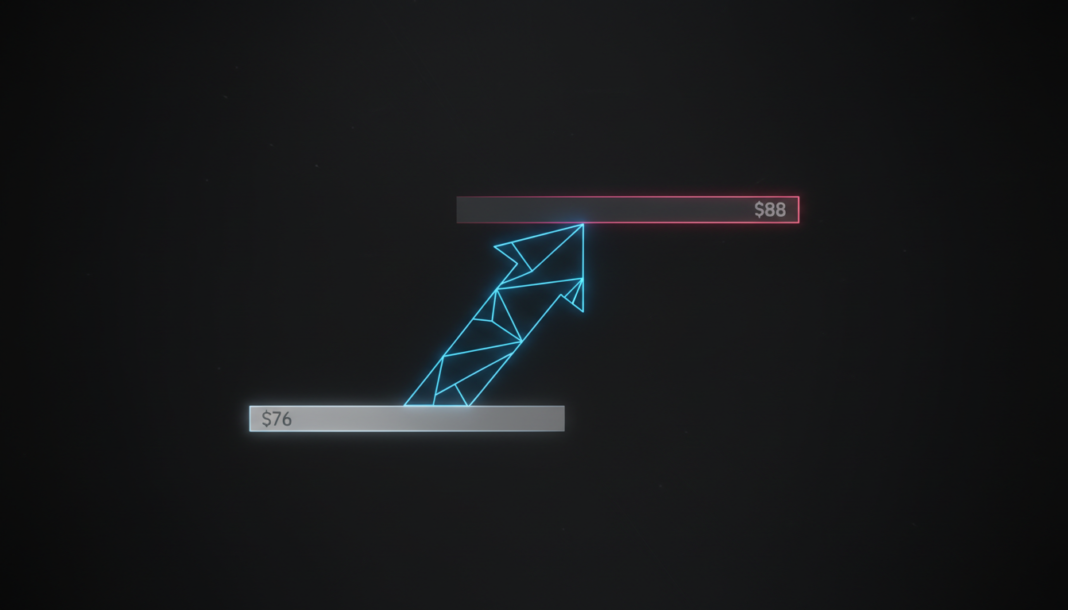

Short-term resistance levels are currently seen at $82 and $88. The MACD indicator remains in bearish territory on the daily chart.

The price sits below both its 50-day and 200-day moving averages. This positioning indicates the macro trend continues to be bearish.

Analyst Ali Martinez indicated on X that SOL may experience upside potential. “SOL may experience upside potential at the $82 or possibly the $88 ranges due to bullish sentiment created by an increase in buying activity,” he stated.

His analysis points to a trading range between $76 support and $88 resistance. A sustained bounce from support could target these higher levels.

Solana is recognized as a Layer 1 blockchain enabling fast, low-cost transactions. The network continues to host active DeFi, NFT, and ecosystem projects.

The price is attempting a relief rally from key support. A confirmed move above $88 with volume is needed for a longer-term trend shift.