The Jupiter (JUP) token rallied over 12% amid hundreds of millions in capital inflows, yet on-chain data reveals a stark contradiction. Core network engagement has plunged to multi-year lows, creating a divergence between its price and fundamental usage, even as total value locked (TVL) surged by approximately $166 million.

The Jupiter [JUP] token attracted substantial inflows, lifting its price by at least 12% over a 24-hour period. This wave of buying pressure was not matched by stronger on-chain engagement, however.

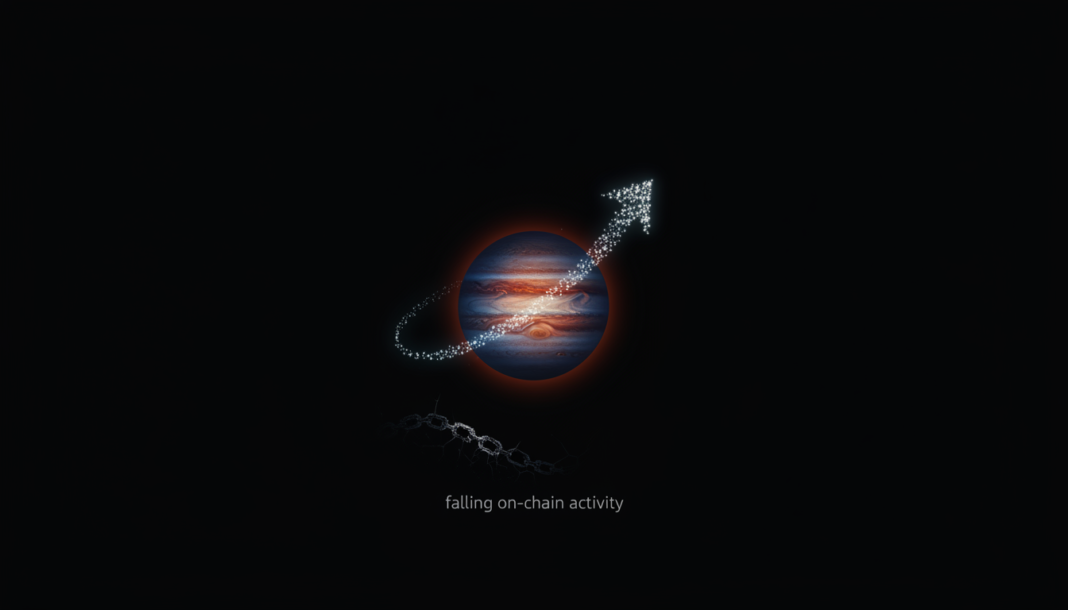

Core network metrics show user participation and transaction activity remain subdued. Data from Artemis indicates daily active users have fallen to their lowest level since February 2024.

Transaction volume has also declined to roughly 1.5 million, a level last seen in January. When network usage declines while price accelerates, the divergence often signals speculative momentum rather than sustainable demand.

Despite weak usage, capital commitment to the protocol increased significantly. Total value locked surged by approximately $166 million to reach $2.163 billion, according to DeFiLlama.

Speculative activity in derivatives markets expanded modestly, with Open Interest rising 13% to $50.29 million. The scale of the TVL inflow suggests spot-driven buying and capital locking played a larger role than futures trading.

Liquidity cluster analysis outlines potential near-term price scenarios. The bullish case suggests limited upside toward $0.18, while a bearish scenario could see a move toward $0.15.