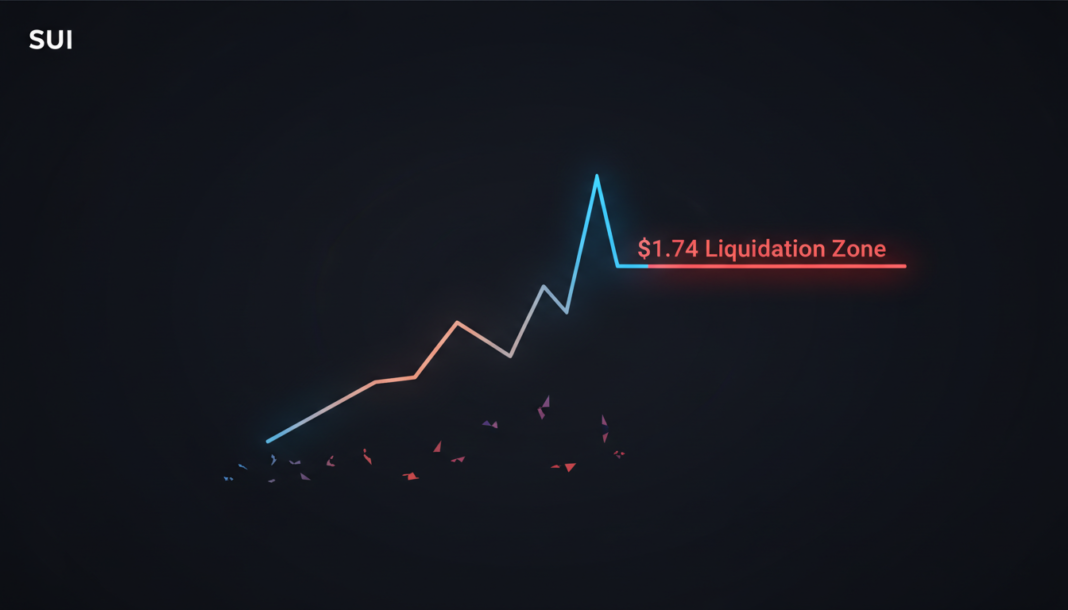

The SUI token faces heavy liquidation pressure, with $143.9 million in short positions at risk if the price climbs near $1.74. The asset remains in a corrective downtrend, trading significantly below its key 20-week moving average. Analysts point to $1.00 as a critical support zone and note that a move above $1.70-$1.80 would be the first signal of a potential recovery.

Cryptocurrency SUI faces unbalanced market positioning, with significant liquidation pressure skewed to the upside. Crypto analyst Eye Zen noted that a price climb toward $1.74 could liquidate approximately $143.9 million in short positions.

On the downside, a drop closer to $0.72 puts about $25.7 million in long positions at risk. This imbalance suggests traders are leaning heavily bearish, leaving the market vulnerable to sharp rebounds if key levels are breached.

Technical analysis indicates SUI is in a sustained corrective phase after a prior bullish move. The token’s price is currently around $0.97, which is far below the key 20-week simple moving average of $1.68.

Multiple attempts to break above this moving average have failed, confirming it as a strong resistance area. The weekly RSI is in a weak 31-35 range, close to oversold but not yet showing clear divergence.

The $1.00 level is currently a major support zone for the asset. A breach below this level could see the price fall toward $0.60 and beyond.

Recovery would require the price to close above the $1.70 to $1.80 range on a weekly basis.