Arbitrum (ARB) faces significant capital outflows and weakening price action, with $56.9 million exiting its ecosystem in 24 hours. The token’s price, while up slightly on the day, has fallen sharply over the week as analysts note it is testing critical technical support levels. On-chain metrics and futures data indicate low market conviction, leaving traders awaiting a decisive directional move.

The Arbitrum ecosystem registered a $56.9 million capital outflow in 24 hours, according to data by Artemis. This outflow adds pressure to ARB’s price, which is down over 16% for the week despite a 3.93% intraday gain to $0.09987.

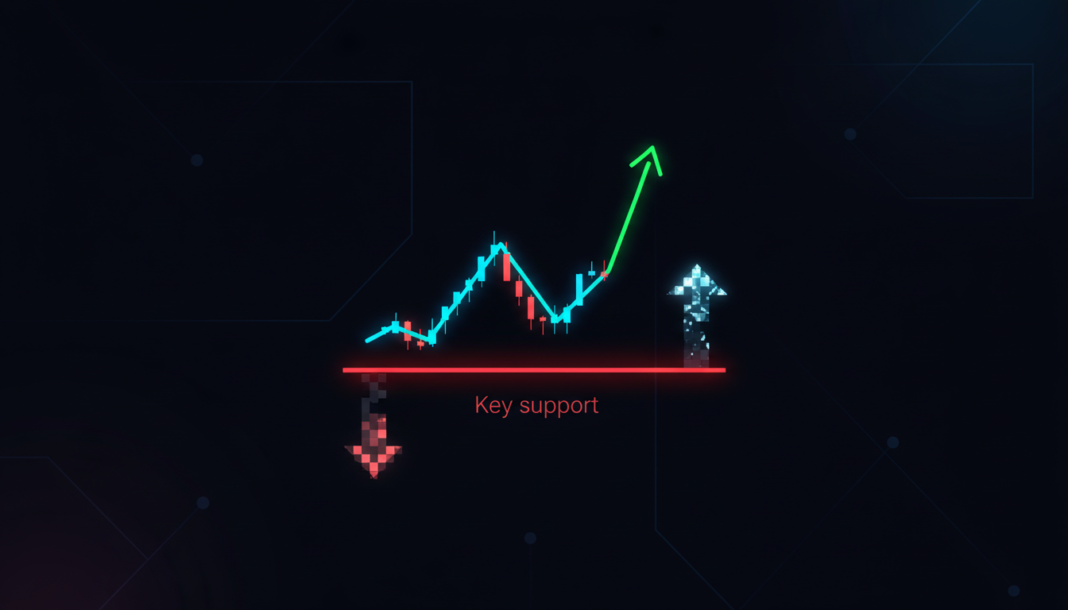

Analyst Nehal highlighted that ARB continues to compress in a falling wedge after a long-term downtrend. “The breakout, supported by a strong weekly close above resistance, could see a sharp move towards the 2+ supply zone,” they stated.

Another analyst, Butterfly, mentioned that ARB is consolidating near the lower boundary of a descending channel on the three-day chart. “The bulls are defending this area as quiet accumulation continues,” they noted, suggesting a move toward $0.70 is possible if momentum picks up.

Technical indicators show the Relative Strength Index (RSI) is deep in oversold territory at 28.96. The Moving Average Convergence Divergence (MACD) also indicates weakening bearish pressure as the histogram turns positive.

Futures market data from CoinGlass shows declining activity, with volume down 10.44% to $304.93 million and open interest down 1.71%. The indicators collectively point to low trader conviction and participation at current levels.