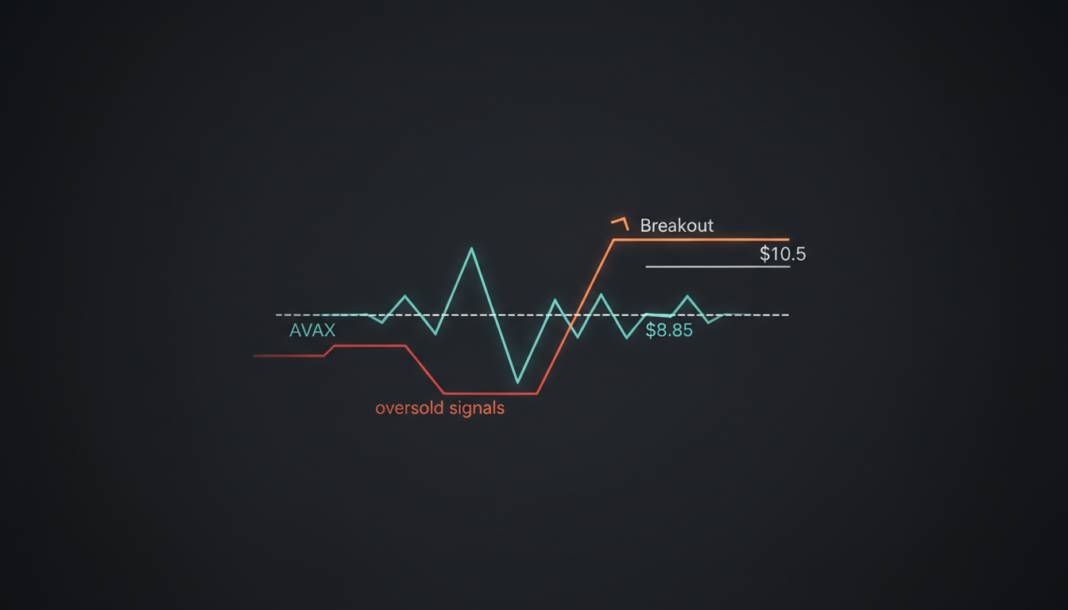

Avalanche (AVAX) stabilized near $8.85 after recent losses, with analysts noting oversold conditions that could prompt a short-term bounce. Key support is seen between $3.0 and $3.6, while resistance levels at $5.4–$6.3 and $7.2–$9.0 are critical for any sustained recovery. Technical indicators show continued bearish pressure, leaving the market in a cautious state.

Avalanche (AVAX) price steadied at $8.85 as buyers entered the market following weekly losses of over 11%. The token’s 24-hour trading volume increased slightly to $241 million according to CoinMarketCap data. Broader macro pressures continue to weigh on altcoin momentum despite early signs of consolidation.

The token’s market capitalization stands at $3.82 billion. Technical indicators suggest oversold conditions which could support a short-term relief bounce if buying momentum persists.

Analyst K A L E O stated that AVAX remains in a long-term downtrend, forming lower highs while revisiting key support at $3.0–$3.6. The analyst noted that sharp capitulation wicks triggered rebounds toward $4.5, stabilizing the broader structure.

Temporary volatility spikes have occurred but macro pressure remains. The current recovery faces resistance between $5.4 and $6.3 with a potential breakout targeting $7.2 to $9.0.

A rejection at the trend line could see AVAX decline to $4.5. A breach of the $3.0-$3.6 support may lead to further decline before any attempt to rally.

The Relative Strength Index (RSI) is at 30.15 indicating strong recent selling pressure. An oversold market may see a bounce but the RSI shows weak momentum with no clear reversal sign.

The MACD remains bearish according to a TradingView chart with the histogram showing decreasing bearish momentum. This suggests possible consolidation or a relief rally combined with the RSI readings.

Understanding the $3.0-$3.6 support and $5.4-$6.3 resistance helps traders determine entry and exit points. Identifying oversold levels assists in anticipating relief rallies or trend reversals.