Binance has published a post-mortem of the 10 October 2025 crypto market flash crash, stating the $19 billion liquidation wave was triggered by macroeconomic shocks, not exchange failure. The report acknowledges two later technical incidents but argues 75% of industry-wide liquidations had already occurred before these issues emerged, framing the event as a market-wide stress test of high leverage.

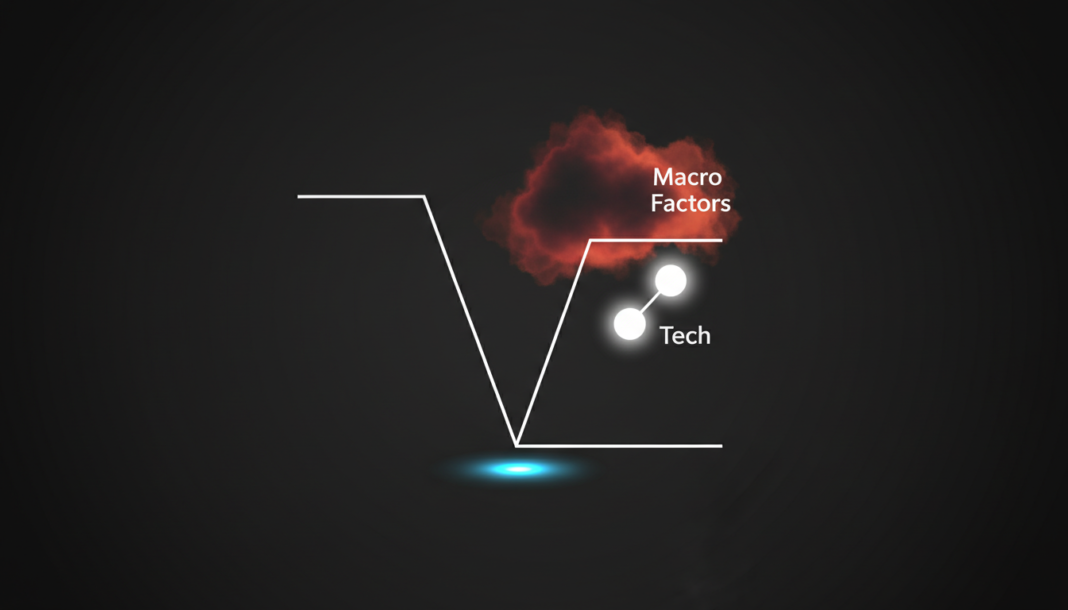

Binance has released a detailed analysis of the 10 October 2025 flash crash, arguing the $19 billion liquidation event was primarily caused by macroeconomic pressures. The exchange stated the “10/10 incident” unfolded amid trade-war headlines, rising bond yields, and broad equity-market weakness.

The clarification follows weeks of public criticism and market speculation about Binance’s role. The report aims to address claims of exchange-side failures by laying out a clear timeline of events.

According to Binance, the most intense liquidations peaked before 21:36 UTC, when localized technical issues briefly affected its platform. The exchange said roughly 75% of total industry liquidations had already taken place by that point.

Liquidation data from CoinGlass supports the scale of the move, showing total liquidations reached $19.25 billion at the peak. Losses were concentrated across multiple major exchanges, indicating a systemic leverage unwind.

Binance acknowledged two platform-specific incidents but described their impact as limited. The first involved a temporary degradation of its asset transfer subsystem, while the second saw abnormal index price deviations for certain assets.

The exchange said it has since tightened deviation thresholds and improved cross-exchange reference pricing. It has also enhanced circuit breakers to reduce recurrence risk.

Binance framed the October flash crash as a stress test of the crypto market’s structure under extreme macro pressure. It pointed to market-maker risk controls and leverage concentration as key amplifiers of the volatility.

The exchange said it has since expanded stress testing and strengthened monitoring for database performance. It has also increased capacity planning for future market shocks.