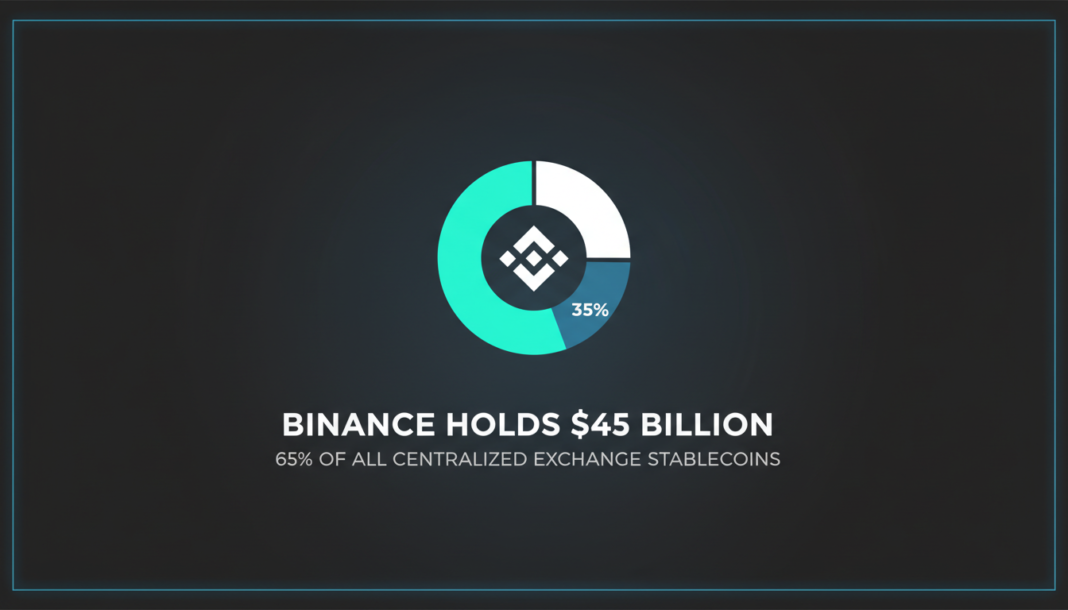

Binance now holds over $45 billion in stablecoin reserves, representing 65% of all stablecoins held on centralized exchanges. This marks a 31% increase over the past twelve months. The exchange’s dominance is evident as competitors like OKX and Coinbase hold significantly smaller amounts. The accumulation coincides with regulatory shifts in the United States that have stimulated stablecoin supply and usage, with a Federal Reserve official noting that such assets reinforce the U.S. dollar.

Binance holds $47.5 billion in USDT and USDC, according to current data. This sum constitutes 65% of all stablecoins held in centralized exchange-controlled wallets.

The reserve represents a 31% increase over the last twelve months. Rival exchanges are far behind, with OKX holding around $9.5 billion and Coinbase near $5.9 billion.

Bybit trails with roughly $4 billion in stablecoin reserves. Capital continues to concentrate at Binance as it houses the majority of the market.

Stablecoins on exchanges are piling up as the U.S. prepares for a major regulatory overhaul. Loosened regulations have hyped the stablecoin market and sparked supply in the past year.

Federal Reserve Governor Stephen Miran recently stated that stablecoins reinforce the US dollar. “I believe that the sweeping deregulation underway in the United States will significantly boost competition, productivity, and potential growth, allowing faster economic growth without putting upward pressure on inflation,” Miran said.