Bitcoin continues to face intense selling pressure, trading near $67,160 after a recent dip toward $65,770. Futures market data reveals a heavily bearish sentiment, with traders paying to hold short positions and the Long/Short Ratio remaining below one for four days. Analysis indicates active downside momentum, suggesting a trend reversal is not imminent.

Bitcoin extended its decline, falling to a low near $65,770 before rebounding to a local high of $67,830. The cryptocurrency traded around $67,160 at press time, reflecting heightened downside volatility amid a prolonged market decline.

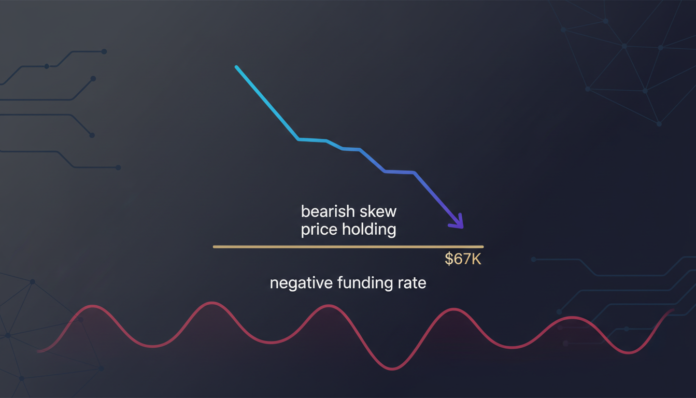

Futures market investors have overwhelmingly exhibited a bearish bias. According to analyst Cryptorus, the market is heavily crowded with short positions, with BTC’s Funding Rate dropping to -0.006.

A prolonged negative Funding Rate indicates derivatives traders are not convinced of a rebound and still expect extended weakness. This sentiment is supported by the Long/Short Ratio, which remained below one for four consecutive days and stood at approximately 0.98.

The analyst observed that an extended negative Funding Rate during consolidations has tended to appear near market bottoms. The Taker Buy Sell Ratio also fell below 1 and remained around 0.9 for four consecutive days after Bitcoin fell below $70,000.

This validates that bearish sentiment strongly dominates the perpetual swaps market with sellers aggressively closing positions. However, prevailing market conditions do not indicate an immediate trend reversal.

Downside momentum remains strong, as evidenced by technical indicators showing active bearish control. Sellers remain in command, risking a further price decline toward the critical support level near $62,380.