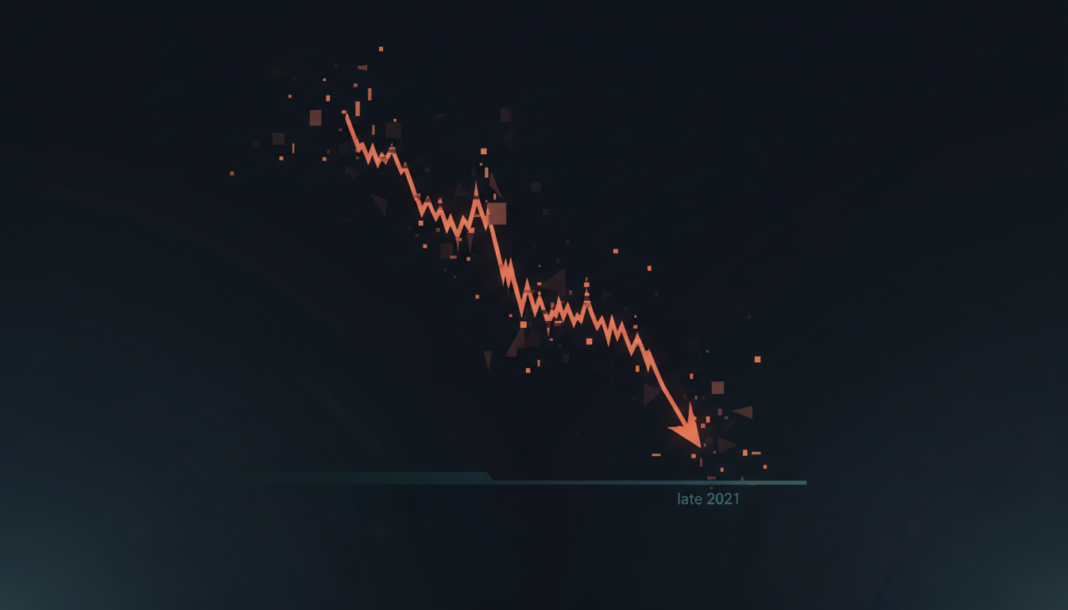

Bitcoin fell below $70,000 on February 5 to its lowest level since late 2021, extending a sharp selloff. The decline confirmed a broader bearish structure after the cryptocurrency failed to reclaim the $90,000 region earlier this year, with on-chain data indicating large holders are reducing exposure and market sentiment deteriorating.

Bitcoin’s selloff intensified on February 5, sliding below $70,000 to levels last seen in late 2021. The move followed a sharp breakdown below the $72,000 support zone on February 4, which had acted as a short-term floor.

Daily trading volume surged as prices fell, suggesting the move was driven by forced selling. The decline confirms a broader bearish market structure in place since Bitcoin failed to reclaim the $90,000 region earlier this year.

On-chain data points to large holders cutting exposure as the downturn accelerated. The entity World Liberty Fi sold 73 WBTC, worth approximately $5.04 million, at an average price of $69,000.

The transaction occurred during the early stages of the breakdown below $70,000. It indicates a defensive risk reduction rather than profit-taking near market highs.

Bitcoin’s adjusted Net Unrealized Profit/Loss metric has also continued to weaken toward neutral and negative territory. Historically, declines in this metric toward zero or below have coincided with periods of market stress and capitulation.

The last time average NUPL entered negative territory was in September 2023, during a prolonged corrective phase. The current reading suggests a growing share of the market is now holding Bitcoin at or below cost basis.

With former support now acting as resistance, Bitcoin faces a technically fragile setup in the near term. A sustained failure to reclaim the $70,000–$72,000 zone could open the door to further downside.