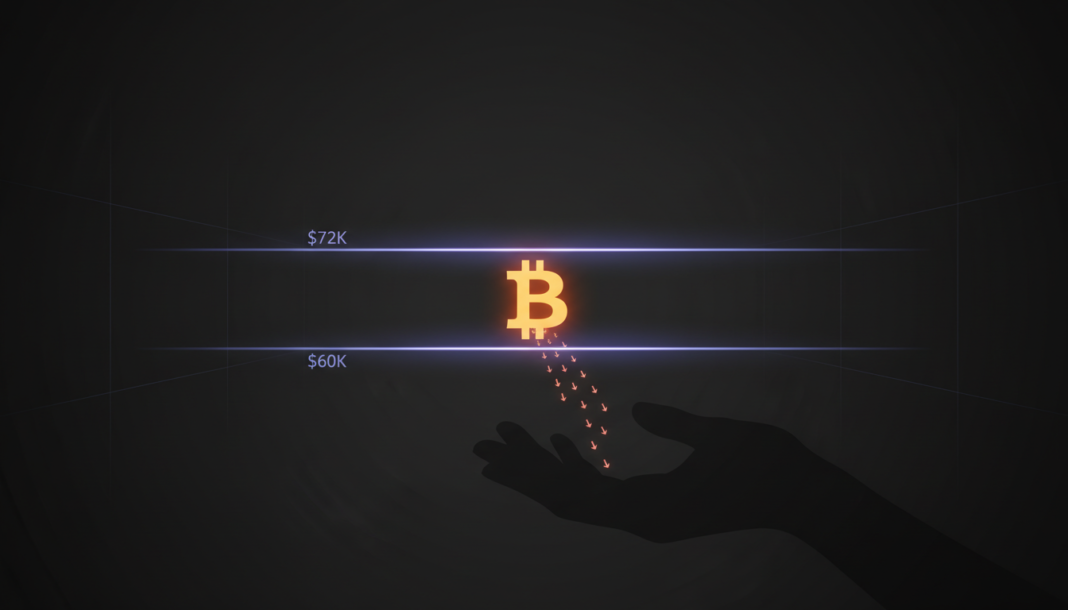

Bitcoin remains range-bound between $60,000 and $72,000, facing resistance from heavy overhead supply according to a recent Glassnode report. Institutional caution is evident, with ETF-led outflows and reduced futures leverage signaling market de-risking. Rising implied volatility and a skew toward downside hedging further indicate uncertainty, with analysts suggesting Bitcoin may stay in its current range without a significant catalyst.

Bitcoin continues to trade within a $60,000 to $72,000 range, constrained by heavy overhead supply according to Glassnode. Since its October 2025 peak, the asset has passed through three distinct market phases before its most recent drop below a key metric known as the True Market Mean.

The current range mirrors patterns from early 2022, situated between the Realized Price of $55,000 and the True Market Mean of $79,200. Analysts believe Bitcoin will likely remain in this corridor without a significant spark or major market shock.

Digital Asset Treasury flows indicate broad institutional reluctance, with net outflows from ETFs, corporate, and government treasuries as Bitcoin neared local lows. “This indicates a de-risking of the market as a whole,” the report states, noting ETFs were responsible for most sales.

Spot trading volume spiked during a sell-off but declined quickly, suggesting reactive trading rather than long-term accumulation. Sentiment in futures markets aligns, with cooled perpetual futures premiums pointing to fewer leveraged bets.

Implied volatility has increased across all maturities, with one-week volatility rising over 20 points. The 25 delta skew is highly negative, reflecting greater demand for downside protection than upside exposure.

Dealers are short gamma with spot near $68,000, which forces them to buy on strength and sell on weakness. Options open interest heat maps show large put options sold below $70,000 and call options sold above $120,000.