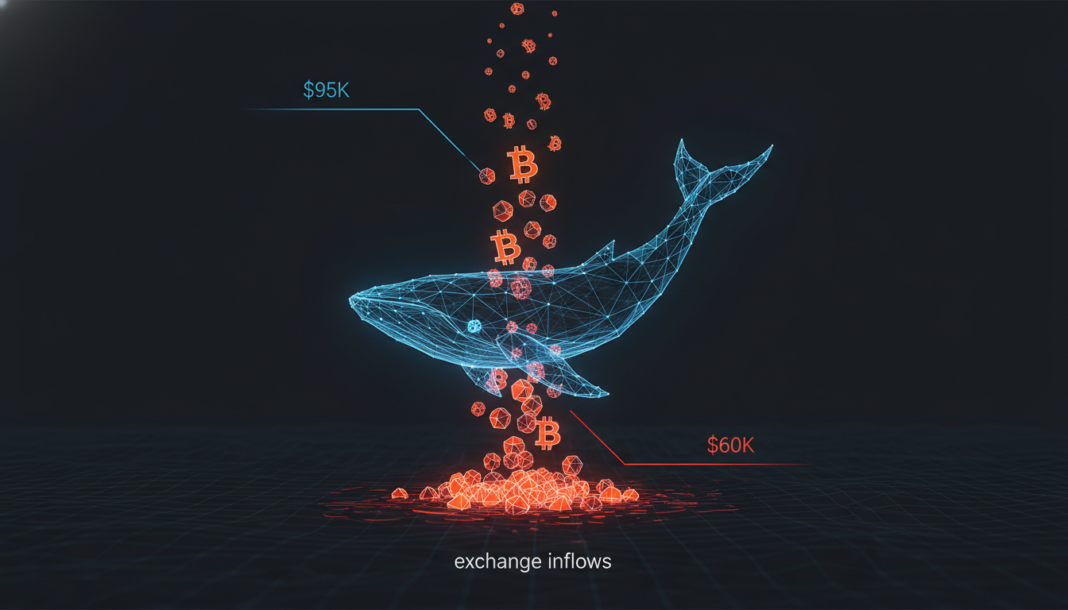

Data tracking Binance inflows from large holders highlights increased selling pressure as Bitcoin’s price declined from approximately $95,000 to near $60,000. Average monthly whale inflows to exchanges surged from around 1,000 BTC to nearly 3,000 BTC, with a single-day spike of roughly 12,000 BTC noted on 06 February. Analysts note that such spikes typically appear during market tops or panic sell-offs, with the current trend suggesting more sellers are active.

Bitcoin’s recent price decline from around $95,000 to near $60,000 coincided with a marked increase in large-holder deposits to major exchanges. According to data, average monthly inflows from entities holding over 100 BTC climbed from about 1,000 BTC to nearly 3,000 BTC.

A substantial single-day inflow of approximately 12,000 BTC was recorded on 06 February alone. Since 01 February, seven trading days have each seen more than 5,000 BTC in daily whale inflows, which is noted as an unusually frequent occurrence.

Analysts state that “spikes like these usually appear during both market tops and panic sell-offs.” The current data suggests more people are selling, raising concerns about reduced capital flowing into the market.

At the time of reporting, Bitcoin was trading well below its 20-day moving average near $77,000, valued at $67,800. The drop toward the $60,000 zone was followed by only a weak price bounce, indicating fragile momentum.

Technical indicators showed the RSI below 40, pointing to a downside pace. The DMI similarly highlighted bearish control, with the negative trend line firmly above the positive one.

Market observers conclude that volatility has returned alongside active whale movement. The verdict is that market bulls still have significant work to stabilize the trend.