Binance Coin (BNB) has declined 14.63% since January 29, a steeper drop than Bitcoin’s 12.29% loss in the same period. Despite the sell-off, both assets remain above key weekly support levels at $74,500 for BTC and $500 for BNB. BNB recently rebounded from a critical support level dating back to August, but technical indicators on the daily chart point to continued bearish momentum.

Binance Coin has seen a sharper decline than Bitcoin since late January. Both cryptocurrencies, however, remain positioned above crucial long-term support zones.

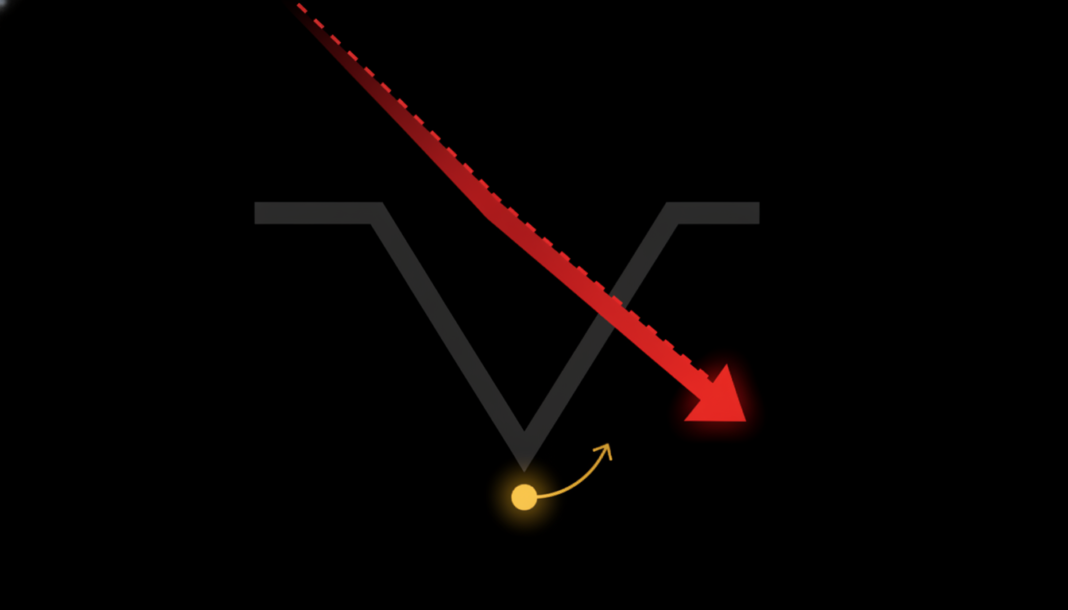

BNB recently tested and held a support level from August. The asset’s daily chart structure turned bearish after breaking below a December low.

Selling pressure drove the On-Balance Volume indicator lower. The overall volume trend for the past month has been upward nonetheless.

The Awesome Oscillator moved below the zero line last weekend. It continued to decline during the recent price drop.

OKX founder Star Xu attributed a past market crash to “irresponsible marketing campaigns” by certain companies. He stated on X that the “market’s microstructure fundamentally changed” after that event.

Bitcoin has not regained its positive correlation with traditional markets since that time. Binance has refuted claims it triggered the major deleveraging event, citing macro shocks instead.

Key overhead resistance for BNB lies between $780 and $790, as well as $810 to $840. The former support zone around $820 could now act as a significant resistance level.

A reclaim of the $840 level would signal a potential bullish shift. To the downside, $730 and $687 are important support levels to monitor.