Cryptocurrency exchange Bybit will launch a retail banking service called “My Bank powered by Bybit” in February. The service will provide users with personal IBANs for U.S. dollar transfers and combine fiat and crypto management. The move follows a major security breach last year and involves partnerships with traditional financial institutions like Qatar National Bank (QNB).

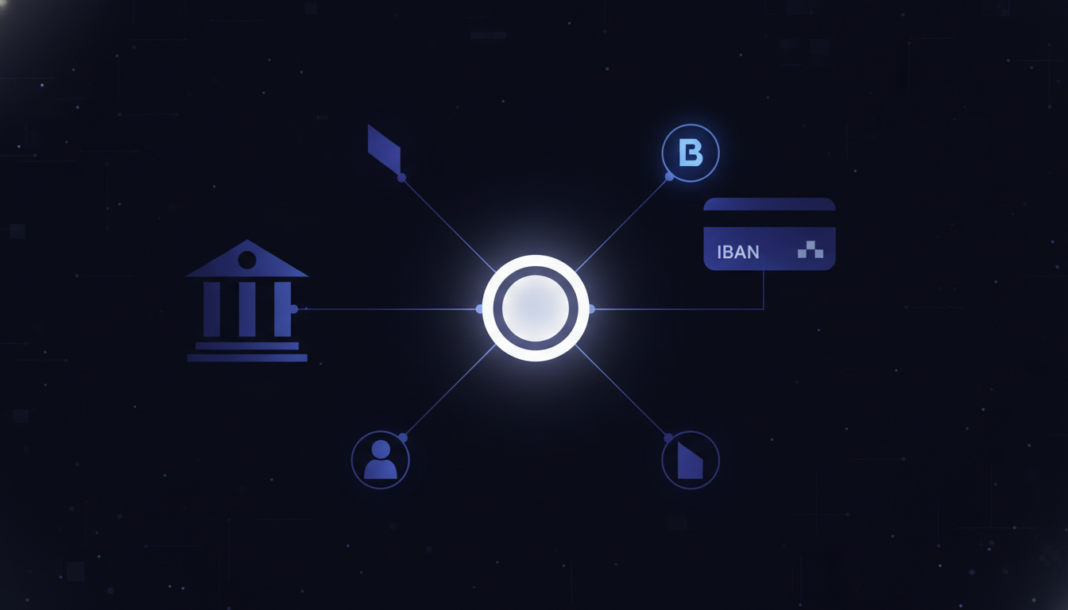

Cryptocurrency exchange Bybit has announced a new retail banking service that will allow users to operate personal bank accounts directly on its platform. The product, called “My Bank powered by Bybit,” is scheduled to launch in February.

CEO Ben Zhou stated the accounts will provide personal international bank account numbers (IBANs) for sending and receiving fiat across currencies. The service will initially support U.S. dollar transfers, with other currencies to follow.

After completing Know Your Customer (KYC) verification, users can deposit fiat, pay bills, receive salaries, and convert funds into cryptocurrency. The exchange stated this is designed to bridge traditional banking and crypto trading in a single platform.

This expansion follows a security breach nearly a year ago where the platform lost approximately $1.4 billion. The company is now working to rebuild user trust and expand beyond pure crypto trading.

Bybit is partnering with traditional banks including Qatar National Bank (QNB) and DMZ Finance to support the launch. Zhou also confirmed that Pave Bank, a licensed startup lender in Georgia, is enabling the new banking functionality.

The exchange did not disclose the full list of supported currencies at launch. More details are expected to be shared as the product rolls out.