In late January 2026, Chainlink (LINK) fell 22%, shattering a key support zone and raising questions about its long-term uptrend. The sharp decline coincided with Bitcoin dropping below $85,000 and saw the asset’s Relative Strength Index hit levels not seen since 2022. Despite the price weakness, data from CryptoQuant showed persistent taker buying, while analysts pointed to a surge in the total supply of LINK in loss as a potential historical bottom indicator.

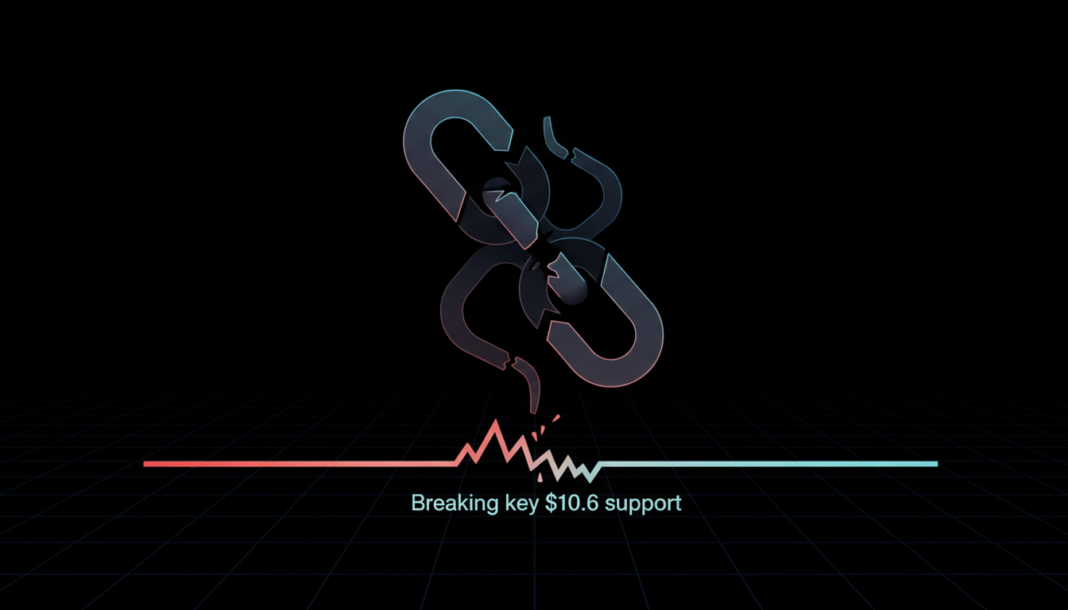

Chainlink’s price suffered a steep 22% drop in the final days of January 2026. This sell-off decisively broke the critical $10.6 to $11.75 support zone that had held since mid-November.

The price move coincided with Bitcoin falling below $85,000, amplifying risk-off pressure across the altcoin market. Chainlink’s Relative Strength Index also dropped to its lowest level since 2022 during this period.

Data from CryptoQuant indicated that despite the sharp drop, taker buying remained dominant. According to CryptoQuant data, despite Chainlink’s [LINK] sharp drop to $13 in November 2025, the Taker Buy Dominant metric stayed elevated, reflecting relentless buying pressure.

CoinGlass Liquidation Heatmaps showed dense liquidity clusters built between $12 and $13 during the sell-off. The price repeatedly interacted with this zone before stabilizing near its lower range.

Analysis from Glassnode revealed the total supply of LINK in loss surged toward approximately 400 million tokens. Historically, spikes in this metric have been precursors to market bottoms and subsequent recoveries.

For instance, during the 2022 market downturn, a similar surge in Total Supply in Loss preceded a strong price rebound. This indicator suggests a significant portion of LINK holders are currently underwater on their investments.