Cryptocurrency exchange Coinbase has aired its first Super Bowl commercial in two years, featuring a karaoke-style text animation of the Backstreet Boys’ “Everybody (Backstreet’s Back).” The ad generated mixed reactions online, which Coinbase stated was the intended outcome to spark conversation. The company’s previous, viral 2022 Super Bowl ad, a bouncing QR code, reportedly drew 20 million website hits in a minute and offered a $15 bitcoin bonus for new sign-ups.

The crypto exchange Coinbase returned to the Super Bowl with a text-animation ad featuring the lyrics to the Backstreet Boys’ 1997 hit. Coinbase marketing chief Catherine Ferdon stated the goal was to create a shared experience highlighting the crypto community’s growth.

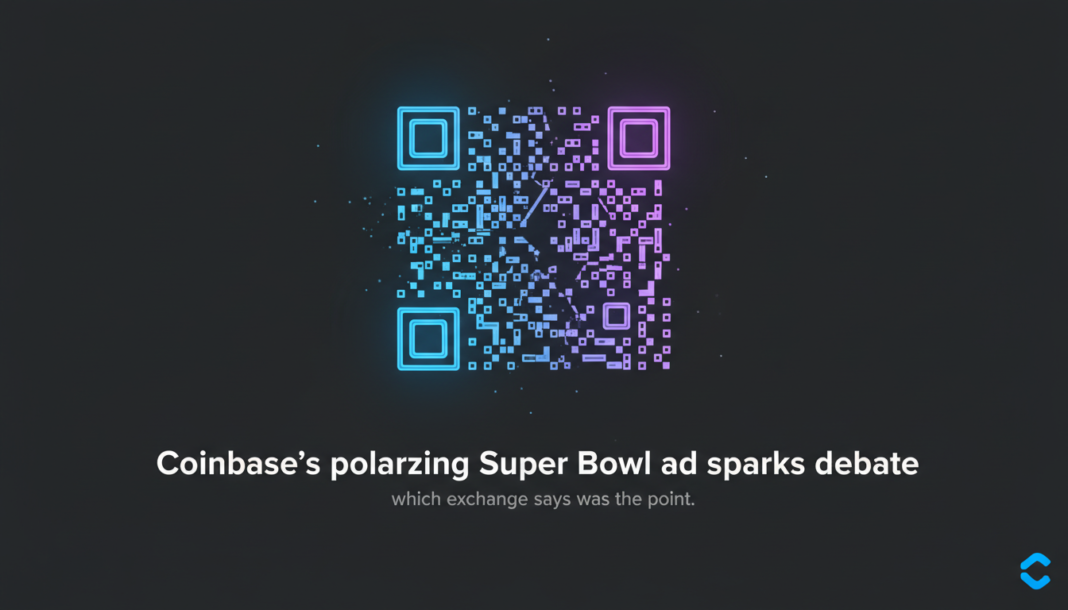

This marks its first Super Bowl spot since a 2022 ad with a bouncing QR code. That code directed users to a sign-up page offering $15 in bitcoin, which reportedly crashed the website with 20 million hits in one minute.

Online reaction to the new advertisement was sharply divided following the broadcast. Some social media users reported negative reactions, while others called the ad memorable and effective for brand recognition.

In response to criticism on social media platform X, Coinbase posted, “If you’re talking about it, it worked.” One user stated a viewing room erupted in boos, while an Axios reporter said a room burst into groans and shouts.

Conversely, an Ethereum Foundation engineer noted half the people at a party were singing along. Another social media user described the approach as “lowkey genius” for creating a lasting brand impression.

Coinbase CEO Brian Armstrong defended the commercial on X. He argued that “most people half-watch commercials… It takes something unique to break through.”