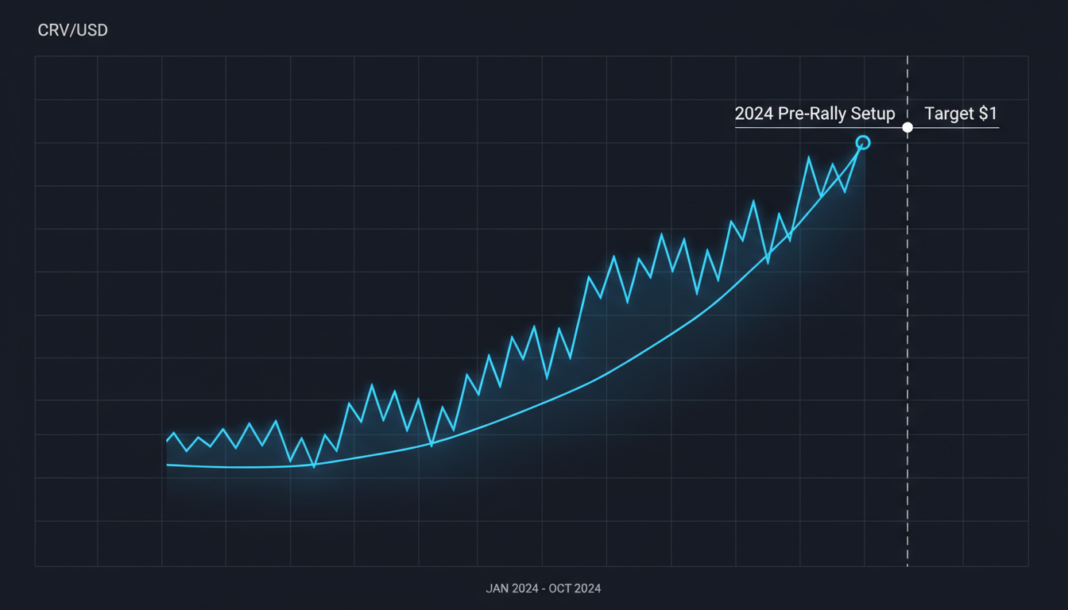

Curve DAO Token (CRV) is exhibiting trading patterns reminiscent of its mid-2024 behavior, where it tested major support levels before a significant price surge. According to analyst Sjuul, the token may see another dip to liquidate weak positions before a potential reversal. Current technical analysis shows consolidation with the price near moving averages, while momentum indicators like the RSI at 52.87 and a positively diverging MACD suggest a balanced market with emerging bullish pressure.

The price action of Curve DAO Token (CRV) is showing similarities to the summer of 2024, when it tested macro support three times before a major rally. Crypto analyst Sjuul stated that “The token may dip lower once more, triggering stop-losses and liquidating weak positions.”

This potential move could set the stage for a final reversal, positioning CRV for an eventual breakout above $1. Therefore, a successful breach of the $1 price level may lead to a major price rally similar to 2024.

TradingView data indicates the asset is in a consolidation phase, trading within a predetermined band and near the middle line. The price is currently above the short-term 20-period Exponential Moving Average but near the 50-period EMA.

The Relative Strength Index sits at 52.87, indicating a balanced market without extreme bullish or bearish pressure. The MACD indicator shows a slight positive divergence at 0.00085, with its signal line at -0.00063, suggesting growing bullish momentum.