The cryptocurrency market endured a significant sell-off, with Bitcoin falling below key support levels amidst a series of concerning developments. A Wall Street Journal report revealed that World Liberty Financial sold a 49% stake to UAE-based Aryam Investment for $500 million shortly before a presidential inauguration. In separate incidents, BitRiver CEO Igor Runets was detained in Moscow on tax evasion charges, and the CrossCurve protocol was exploited for an estimated $3 million, forcing an emergency halt of its bridge.

Cryptocurrency markets faced a broad sell-off, with Bitcoin losing critical price levels. Multiple unsettling headlines contributed to the day’s negative sentiment across the sector.

World Liberty Financial sold a 49% stake to UAE-based Aryam Investment in a deal worth $500 million, according to a report. The agreement was signed just days before a presidential inauguration, despite the company having no live products at the time.

Aryam is backed by Sheikh Tahnoon bin Zayed Al Nahyan, the UAE’s national security advisor. Earlier this year, an AI firm he chairs invested $2 billion into Binance using WLF’s stablecoin without disclosing its indirect ownership.

Separately, BitRiver founder and CEO Igor Runets was detained in Moscow on allegations of tax evasion. Local media reports state he was formally charged with three counts related to hiding assets.

Runets built BitRiver into one of Russia’s largest Bitcoin mining operators. The firm has faced difficulties since being sanctioned by the U.S. in 2022.

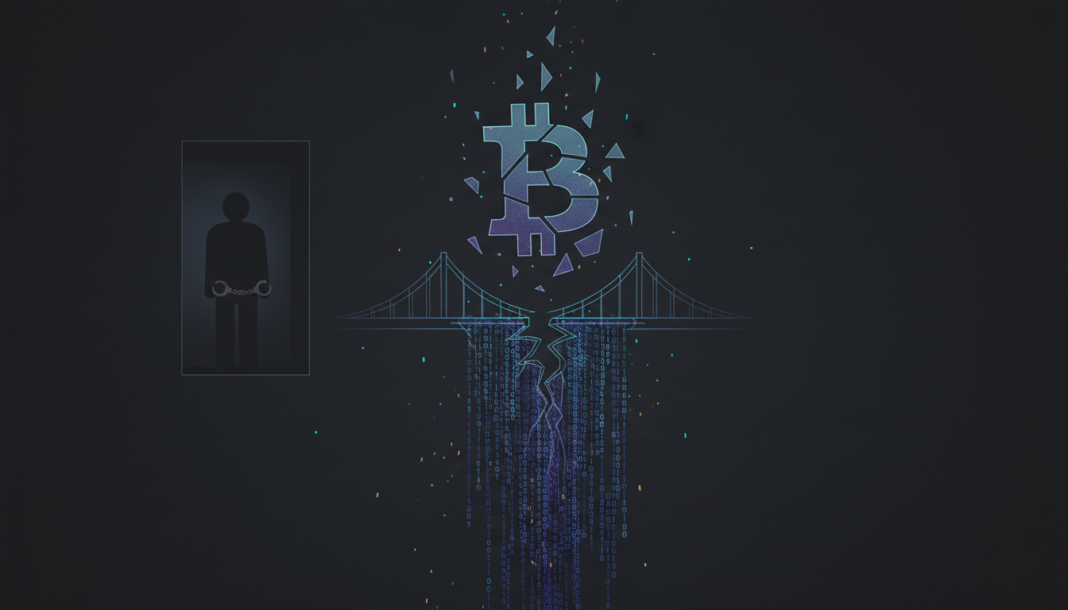

The CrossCurve protocol asked users to stop interacting with its platform after confirming a smart contract attack on its cross-chain bridge. An estimated $3 million was reportedly drained across multiple blockchain networks.

The team stated the issue stemmed from a flaw in one of the bridge contracts. This flaw allowed unauthorized transactions to bypass normal validation checks.

In response, CrossCurve CEO Boris Povar publicly addressed the wallets believed to have received the stolen funds. If the assets are returned in 72 hours, he’s offered a reward of up to 10%.

The team has stated that it is prepared to involve law enforcement and pursue legal action if needed. Partner protocol Curve Finance cautioned users who had exposure to CrossCurve-related pools.