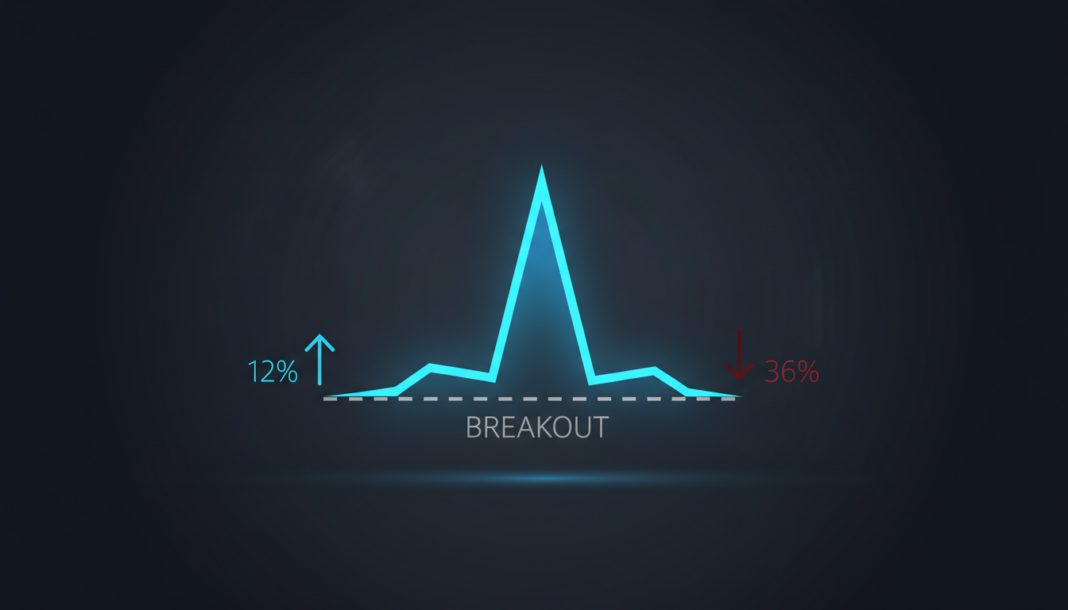

The cryptocurrency DEEP surged 12% to $0.032, breaking free from a long-term downtrend despite trading volume declining by 36%. While technical indicators show a potential bullish shift, major traders on Binance remain heavily net short, creating a volatile standoff between market structure and trader positioning.

The cryptocurrency DEEP gained 12% to $0.032 as its breakout from a multi-month descending channel signaled a potential structural shift. However, this price strength was accompanied by a 36% decline in trading volume, raising questions about the momentum’s fundamental support.

Despite the lower volume, buyers continued to defend the $0.031 region, absorbing supply at current levels. The Directional Movement Index revealed the +DI at 23 and the –DI at 21, with the ADX reading of 26 indicating strengthening trend intensity.

Market data from CoinGlass showed Open Interest rising 9.32% to $11.46 million, signaling new capital entering the derivatives market. This expansion during a breakout typically amplifies potential volatility in either direction.

Conversely, top traders on Binance maintained a skeptical stance, as shown by the platform’s Long/Short Ratio sitting near 0.62. Short positions accounted for over 60% of total positioning, revealing a significant divergence between price action and professional sentiment.

This crowded short positioning could fuel a rapid price move if the breakout holds. The key zone between $0.031 and $0.033 now acts as a critical pivot for determining the trend’s sustainability.