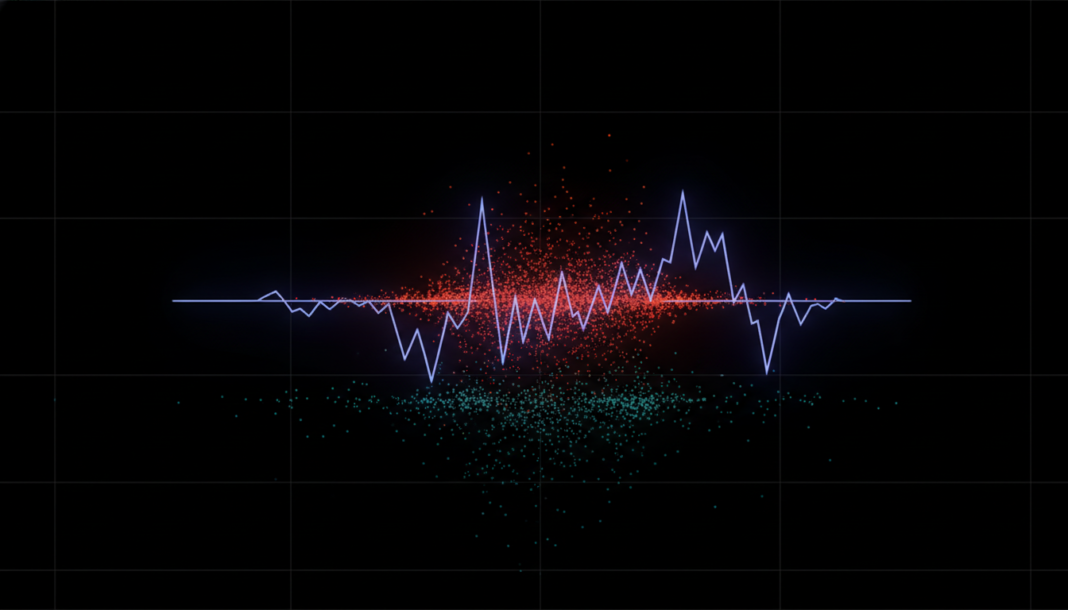

Onchain data from Glassnode indicates Ethereum is trading within a crucial holder breakeven zone between roughly $2,900 and $3,100. This dense concentration of supply suggests heightened market friction, where minor price movements could significantly influence investor behavior as many decide whether to hold or sell.

Onchain analysis reveals Ethereum’s price is positioned directly within a major supply cluster where many holders last acquired their tokens. This area typically creates elevated friction for price action as marginal moves prompt portfolio reassessments.

The densest concentration of ETH supply lies between $2,900 and $3,100, according to the firm’s Cost Basis Distribution Heatmap. A secondary accumulation zone exists between $3,300 and $3,500, which has acted as overhead supply.

Historical accumulation thins notably below $2,700, indicating less natural cost-basis-related demand. This suggests a decisive move below the current band could increase price sensitivity to directional market flows.

Ethereum was trading around $2,930–$2,950, remaining below its 50-day and 200-day moving averages. The asset has traded within a broad sideways range since a sharp drawdown from October highs.

Recent sessions show muted follow-through on both rebounds and pullbacks. Trading volume has also moderated compared to earlier volatility spikes.

The data shows ETH is neither reclaiming higher cost basis bands nor breaking decisively below the current cluster. This suggests market participants are negotiating value rather than reacting to a dominant directional catalyst.