Ethereum has fallen below a key long-term support level of $2,111, with that level now acting as resistance. Analysis indicates seller dominance in the market, but a migration of ETH to long-term holders and staking contracts suggests underlying capital consolidation. Analysts describe the asset as being compressed like a spring, with a potential for a significant move once broader market sentiment shifts.

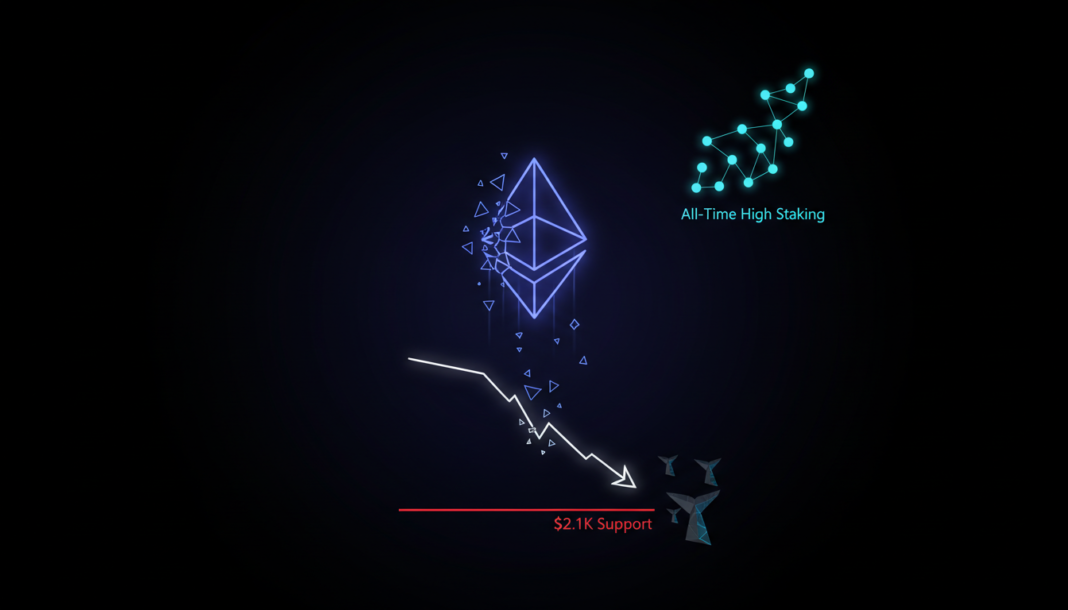

Ethereum fell below its long-term swing low set at $2,111. Over the past ten days, this former low has served as resistance against bullish attempts to push prices higher.

Whale deposits to centralized exchanges and a falling taker buy-sell ratio reflected seller domination in execution. However, a sustained decline in ETH exchange reserves argues for supply scarcity and long-term positioning.

The migration of ETH into the hands of high conviction, long-term holders limits rapid distribution capacity. The amount of Ethereum deposited into staking contracts has reached an all-time high too, according to the report, which described this as a sign of capital consolidation.

In the long-term, ETH appeared to be compressed like a spring. The analysis suggested the spring could unwind explosively once macro conditions change and capital flows back into the crypto sphere.

The prevailing trend has remained firmly bearish, however. At the time of writing, the $2,100-level was a local resistance, with another supply zone overhead between $2,500 and $2,750.

The On-Balance Volume indicator has been making lower lows and lower highs since October, characteristic of a downtrend. The Moving Average Convergence Divergence was below the zero line but showed a recent bullish crossover.

A three-month liquidation heatmap revealed a sizeable cluster of liquidations building up far away in the $3,400 to $3,800 range. More locally, magnetic zones were building up around $1,550-$1,700 and $2,150-$2,550.

After a violent move, prices tend to consolidate sideways to build up liquidity. The analysis noted this action effectively traps breakout traders as prices reverse between bands.

This suggests a drop toward $1,600 would likely present a long-term buying opportunity in the coming months. The report clarified this does not guarantee a market bottom, which also depends on Bitcoin and macro conditions.

Consolidation between $1,800 and $2,100 would be likely before any such move. A move up to $2,500 over the next month or two is possible but would be heavily laced with the likelihood of another bearish price reaction.