Ethereum (ETH) has experienced a significant downturn, dropping 9.57% to $2,376.90 in 24 hours amid a broader market decline. Despite oversold conditions and a prediction for a five-day rise to $2,685.26, technical indicators and market sentiment remain overwhelmingly bearish.

Ethereum is trading at $2,376.90 following a sharp 9.57% decline over the last day. The broader cryptocurrency market saw its overall value decrease by 7.77% during the same period.

The asset has fallen 21.99% over the past 30 days and 27.08% from its price of $3,259.58 one year ago. Its all-time high of $4,946.50 was reached on August 24, 2025.

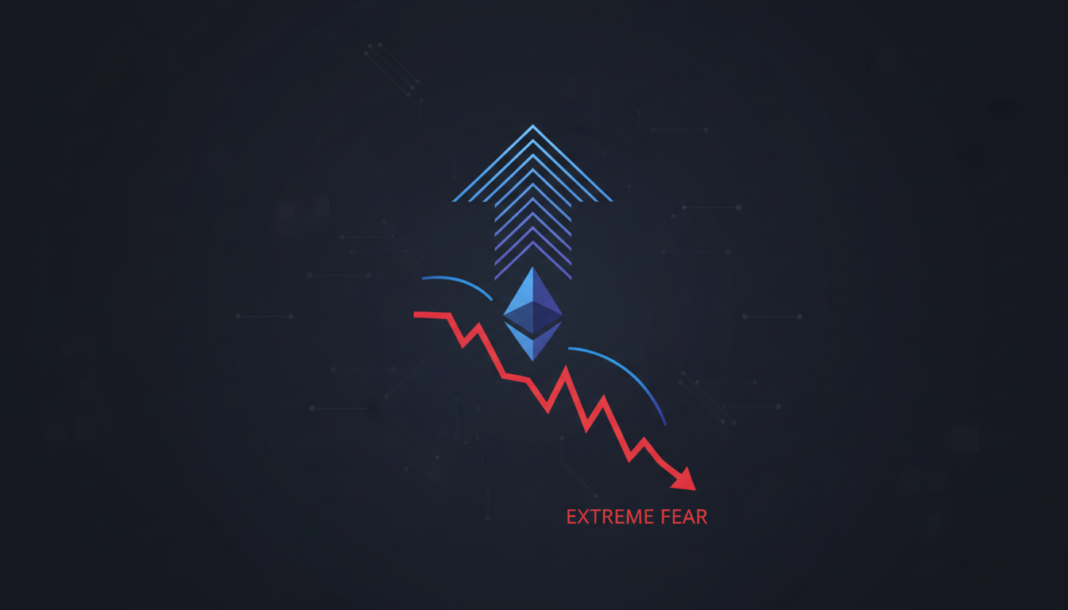

A short-term price prediction mentioned in data forecasts ETH rising to $2,685.26 by February 6, 2026, representing a 10.65% increase. The medium- and long-term trends, however, maintain a negative assessment.

The technical outlook shows bearish tendencies, with 28 indicators signaling downward movement against only 5 pointing up. “The assessment indicates that 85 percent of monitored indicators indicate a negative forecast.”

Some signals suggest a potential bounce, as the Relative Strength Index (RSI 14) reads 26.15, indicating oversold conditions. ETH also currently trades above its 50-day and 200-day Simple Moving Averages.

Market psychology reflects extreme fear, with the Fear & Greed Index at a value of 14. The price faces key support levels at $2,273.97, $2,103.85, and $1,885.89.