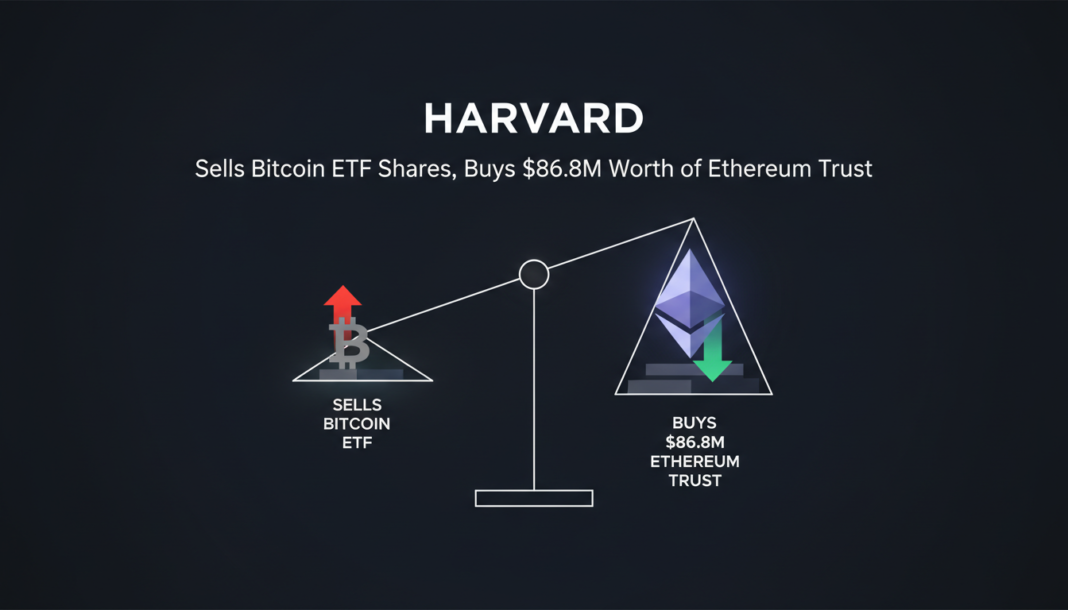

Harvard Management Company has trimmed its Bitcoin holdings and allocated a portion into Ethereum, according to a recent SEC filing. The Ivy League endowment sold 1.46 million shares of BlackRock’s iShares Bitcoin Trust (IBIT) in Q4, while opening a new $86.8 million position in the iShares Ethereum Trust. This move represents a relative value rotation by one of the world’s most prominent institutional investors as the combined crypto ETF exposure remains over $350 million.

Harvard Management Company disclosed in an SEC 13F filing that it reduced its holdings in **BlackRock**’s iShares Bitcoin Trust (IBIT) during the fourth quarter. The sale of 1.46 million shares left the endowment with approximately $265 million in IBIT.

Concurrently, Harvard opened a new position of 3.87 million shares in BlackRock’s iShares Ethereum Trust, valued at roughly $86.8 million. Their total spot crypto ETF exposure at the quarter’s end exceeded $352 million.

The endowment had first disclosed a $116 million IBIT position in August 2025 and tripled it to around $350 million by November. Industry observers suggest this latest move is a strategic shift in allocation.

Sean Bill, co-founder of Bitcoin Standard Treasury Company, stated that Harvard is likely “making a relative value trade with the belief that ETH is undervalued relative to BTC.” Jennifer Ouarrag of Twinstake described it as a “recalibration toward assets with multiple return drivers.”

She noted Bitcoin remains “the primary institutional store-of-value proxy,” while Ethereum offers exposure to a broader smart-contract ecosystem. This rotation indicates major institutions are now actively analyzing the performance relationship between the two leading crypto assets.

In broader market news, crypto majors traded slightly lower, with Bitcoin near $68,000 and Ethereum holding around $1,970. The fast-food chain Steak ‘n’ Shake reported a dramatic sales increase over nine months following its Bitcoin adoption.

Separately, cryptocurrency exchange Kraken will sponsor Trump Accounts for newborns in Wyoming. In DeFi, developer Andre Cronje opened the Flying Tulip public token sale, priced at a $1 billion valuation.