Hedera Hashgraph (HBAR) is trading at $0.09017 with a market cap of $3.88 billion, facing critical support and resistance levels. The token’s price action shows a test of key support near $0.072, with technical indicators presenting a mixed outlook. Analysts note that a break below $0.046 could lead to a deeper decline, while surpassing resistance at $0.126 is needed to signal a potential trend reversal.

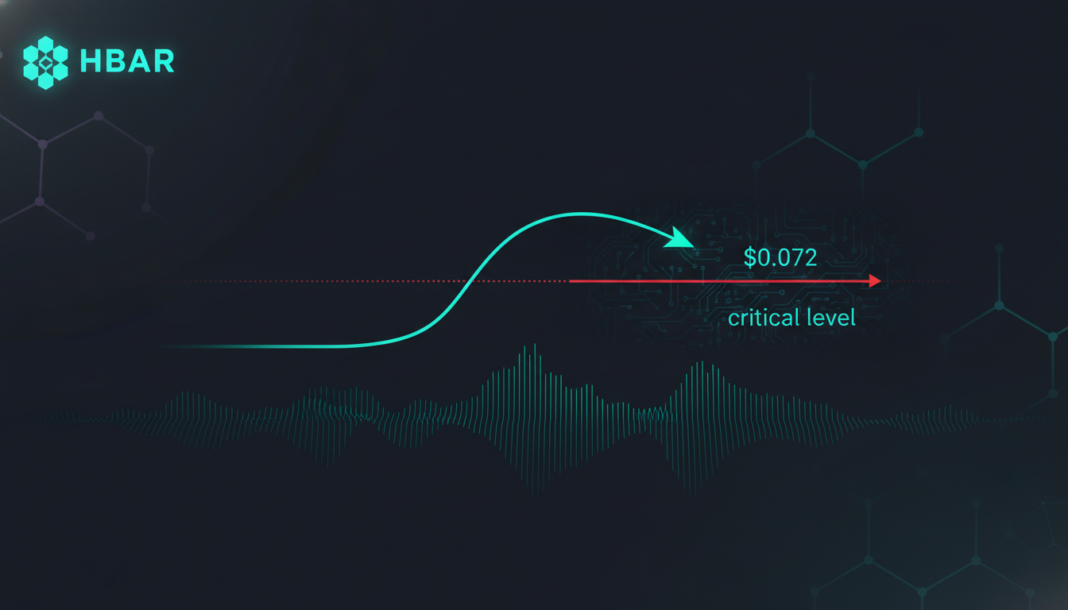

Hedera Hashgraph (HBAR) is trading at $0.09017 with a 24-hour trading volume of $169.83 million and a market capitalization of $3.88 billion. The asset is currently testing a crucial support level near $0.072, which marks its October low. Analysts consider this level key for potential price stabilization in the near term.

The token faces significant resistance between $0.126 and $0.177, levels that must be breached to indicate a strong market recovery. On the downside, a failure to hold the $0.046 support level risks a deeper price decline. This is stated by market observers monitoring the technical setup.

Technical analysis shows mixed signals for HBAR’s outlook. The weekly Relative Strength Index (RSI) indicates oversold market conditions, while the price is nearing the 0.786 Fibonacci retracement level, often viewed as a potential reversal zone. However, no clear bullish divergence has yet been observed on the charts.

Recent price action saw HBAR decline by 2.71% over 24 hours, reflecting ongoing market caution. Analysts have pointed out that unusual weekend volatility could lead to temporary selling events. Any price movement above current levels is currently viewed as a correction rather than the start of a new bullish trend.