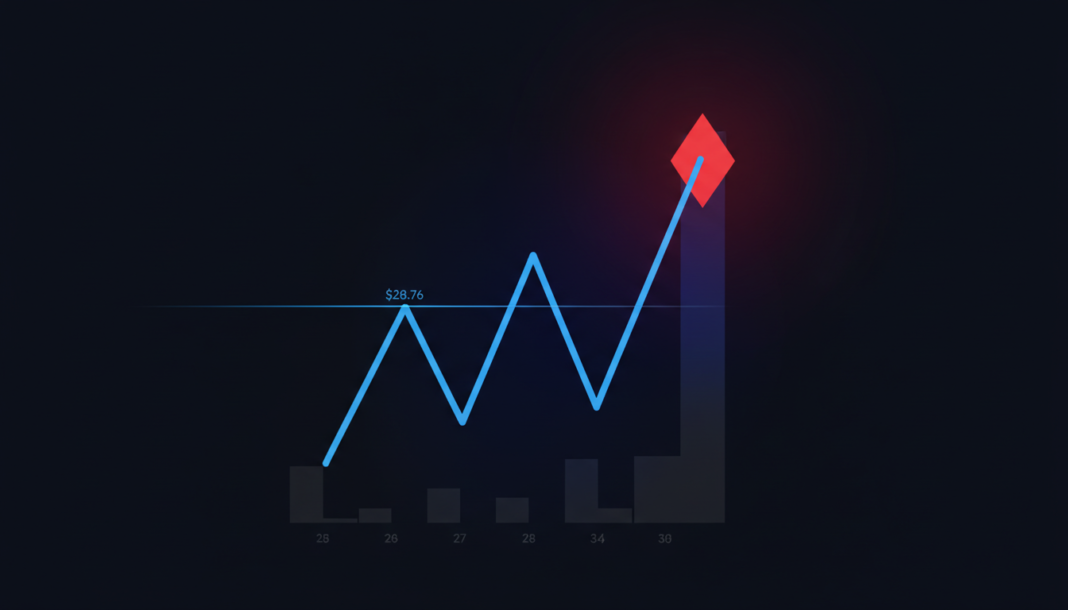

Hyperliquid (HYPE) is trading near $29.71, showing declines over recent daily and weekly periods. Analysts note the token is testing a critical technical juncture at the $28.76 support level, with a potential breakout above the $31.73 resistance targeting higher prices. A failure to hold support could see the price move toward $23.

The Hyperliquid (HYPE) token is approaching a crucial technical level. Market participants are watching to see if HYPE can rise above resistance at $31.73 or drop below support at $28.76.

Short-term technical indicators continue to decline as volume dries up. This signals a potential volatility explosion for the asset.

As of the latest data, HYPE is changing hands at $29.71. This represents a 1.45% decline over 24 hours and a 5.64% decrease over the past week.

Trading volume has dropped sharply by 55.78% to $87.44 million. The price action is occurring amid a notable reduction in market activity.

Analyst Umair Crypto highlighted that a successful rise above the 50-period Simple Moving Average at $31.73 could lead to the next resistance at $35.47. He noted this moving average has rejected price action six times.

The analyst stated, “if the price drops below the neckline, the bullish pattern will be negated, and the price may move toward the $23 region.” The $28.76 level marks the neckline of an inverse head and shoulders pattern.

Another analyst, Altcoinpedia, mentioned that Hyperliquid has gained popularity in decentralized finance due to its high-speed execution and liquidity structure. The price recently rose above $31 before retracing toward $30.

They further mentioned the price may move toward $38, as the liquidity structure could lead to an expansion phase. Price targets depend on confirmation based on buying pressure and a break above resistance.

The 20-day moving average is serving as dynamic price support currently. A reaction around this average would suggest bulls maintain short-term control.