U.S. spot Bitcoin ETFs saw a significant $330.7 million in net inflows on Feb. 6, marking a sharp turnaround after days of massive outflows. This activity, led by BlackRock‘s IBIT, suggests institutional investors may view current price levels as a buying opportunity, contrasting with retail sentiment captured by an “Extreme Fear” reading on market indices.

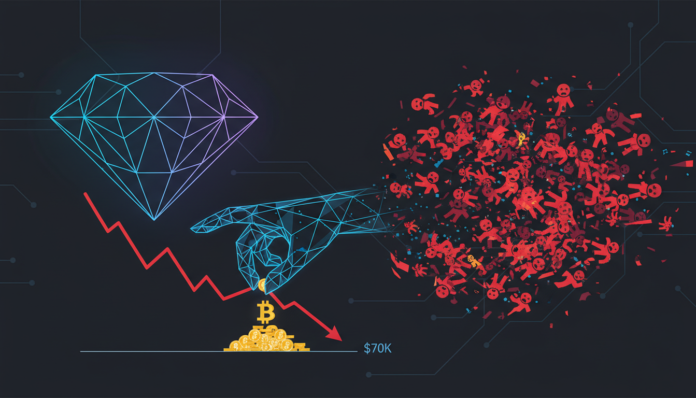

The cryptocurrency market presents a contradictory picture as Bitcoin trades below $70,000. While retail sentiment has turned pessimistic, institutional investors displayed different behavior through U.S. spot Bitcoin exchange-traded funds (ETFs). Data shows these funds recorded $330.7 million in net inflows on Feb. 6 after experiencing substantial outflows earlier in the month.

This sharp reversal was primarily driven by BlackRock‘s IBIT, which attracted $231.6 million. Other ETFs like Ark Invest‘s ARKB and Bitwise‘s BITB also saw inflows of $43.3 million and $28.7 million, respectively. The activity suggests large financial players may see current prices as a strategic entry point.

The first week of February revealed considerable volatility in institutional positioning. Following a positive start with $561.8 million in inflows on Feb. 2, the next three days saw massive outflows totaling approximately $5.16 billion, including a single-day withdrawal of $4.34 billion on Feb. 5. The Feb. 6 inflow reversal coincided with record trading volume for IBIT, which reached $10.7 billion.

Retail fear, however, remains elevated as the Crypto Fear and Greed Index dropped to a reading of 8, indicating “Extreme Fear.” Concurrently, Bitcoin’s market dominance remains high at nearly 59%, suggesting capital may be rotating from altcoins into Bitcoin. Experts like Arthur Hayes have characterized recent selling as mechanically driven by institutional rebalancing rather than panic.