Jupiter (JUP) is trading near a critical support level at $0.1553 amid a market downturn. Analyst Jonathan Carter notes the token is testing a descending channel boundary, with potential for a rebound toward targets up to $1.50. Simultaneously, Jupiter’s integration with prediction market Polymarket brings Solana-based event trading to its platform, following Polymarket’s $7.66 billion monthly volume.

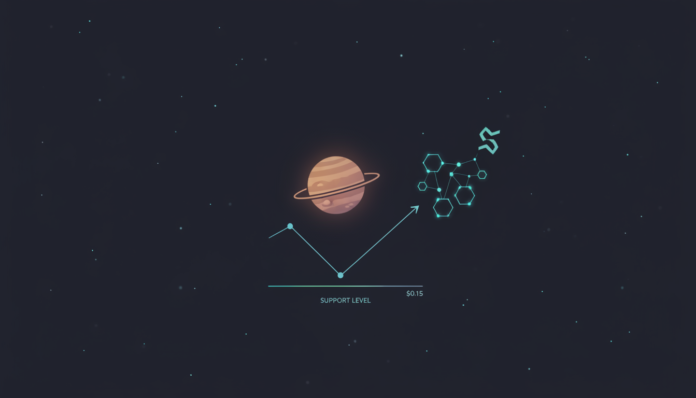

As of Tuesday, February 10, 2026, Jupiter (JUP) is trading at $0.1553, a 3% decline over 24 hours. Despite the drop, daily trading volume increased 1.55% to $27.35 million as the token tests a key technical support zone.

In an X post, crypto analyst Jonathan Carter of Crypto Insights commented on the price action. “The convergence of JUP’s descending channel lower boundary with horizontal support suggests a potential rebound.” He added that a successful hold could see the price rally toward targets between $0.23 and $1.50.

Carter cautioned that medium-term momentum remains bearish below the 50-day moving average. Failure to hold support could extend downward pressure along the established channel.

In a separate development, Jupiter recently announced the integration of Polymarket’s decentralized prediction markets. This collaboration enables users to trade event contracts directly within the Jupiter interface.

Polymarket recorded $7.66 billion in trading volume in January 2026, up from $5.31 billion in December. This expansion positions Solana as a hub for merging decentralized finance with mainstream event-driven trading.